In Search of Policies for Aged Chinese Women

With the aim to exploring the policiesfor aged women in China, we entered this field, and found it a rich one, including free public transport, welfare facilities, pensions, care service for the aged, and special medical care, etc. In this paper, the key area we selected is to analyze the pension system with a gender perspective. The reasons for choosing this area are that it is the basic guarantee for the elders to live a decent life after they lose their working ability, is the fundamental factor for people to survive, and the key issue for the change from family-based old-age care toward a society-based one.

There are no special policies for aged women; while the pension system for women has been embedded into the overall pension system, which was established in 1950s. The system was originated in urban regions and has been in operation for half a century. It was designed and funded according to the worker’s wages. Meanwhile, the standard was differentiated according to the labors’ social status. There are three layers designed for the pension system, namely public servant on the top, enterprise workers in the middle, and farmers at the bottom. Pension for women has been included in these three layers and they share relevant treatment. Besides, within each layer, there are certain rules in light of gender.

The main contents of the paper are the features and rules of China’s pension system, the gender oriented rules within the system, the forming of gender differences within one certain layer, and the influences these rules lay on the elders with the specialty of women.

This article looks at the Chinese pension system in a gender-based perspective, analyzes the overlapping and interaction of the system between urban and rural areas, among different classes of society, and between different genders, and thus looks into how the existing pension system has resulted in gender-based gap, and how it has widened, either consciously or unconsciously, the pension entitlement gap between men and women.

Keywords:

gender-based perspective, pension, gap between urban and rural areas, gap among different classes of society, gap between men and womenGaps between Urban and Rural Areas and between Men and Women under the Pension System

The Chinese pension system embodies obvious gaps between urban and rural areas as well as hidden differences between men and women. In 1951, as the socialist system was founded, pension became a social welfare policy falling into focused consideration of the government. In 1951, the Political Council then enacted the “Labor Insurance Regulations of the People’s Republic of China,” wherein Section 15 specified pension treatment by providing that male employees and officers could retire at 60 and after 25 years of general service or five years of service in their current employers. The “Temporary Measure for Handling Retirement of Employees in Governmental Authorities” issued in 1955 provided the measure for retirement of employees in governmental authorities. A suite of retirement and pension policies has thus taken its shape. Here, three groups of people were covered by pension, namely workers, employees and officials, all with registered permanent residence in urban areas. Such pension policies splitting the urban and the rural area had been in continued implementation for 48 years and the pension system offering different treatment to rural and urban residents was not broken until the end of last year.

Urban employers with salary income are entitled to certain percentage of pension after their retirement, which is a distinct characteristic of the design of the Chinese pension system, the identification of employees focuses on salary income and laborers without salary income are excluded, which is related to the source of pension contributions, as pension fund originates from revenues of enterprises, and farmers cannot enjoy pension as they do not receive any salary income. Such design of the system has resulted in two problems. One is that most farmers are excluded from the social security system, which has in turn caused significant differences between urban and rural pension systems. Since then, a dualistic pension pattern has come into being to lead to persistent splitting between rural and urban areas in terms of pension treatment, that is, urban aged residents primarily depend on the pension system, they need not rely on their children and are financially independent; while aged people in rural areas are mostly dependent on their families, they do not have their own pension and have to rely on their children to support their life. As a result, the traditional idea of farmers of having sons in preparation for their aged life has become realistically necessary. The result is that old people in urban and in rural areas are faced with different problems, those facing old people in cities are mostly in connection with loneliness, while problems facing the aged in rural areas are those relating to their basic survival, and lack of human dignity appears more obvious in rural areas. The financial dependence and pension problems are particularly severe with old women in rural areas. We once interviewed an old female village secretary who had worked as a village official during her entire career life but has no source of income. In order to avoid difficulties during her aged life, she remarried an urban official after her husband’s death, ignoring the strong opposition from her sons, solely for the purpose of getting a pension payment of RMB 300 each month. She said that is the only way to prevent a miserable life after she got aged.

The other problem is that a large majority of housewives in cities and towns can hardly obtain pension entitlement. To be qualified for pension in cities, one should generally meet either of two conditions. One is that he/she must have a job. During the period when China was still in the planned economic system, jobs were closely linked with income, and housewives are naturally excluded from pension as they had no salary income. The other condition is the sufficient financial strength to support commercial pension insurance coverage. In cities, one can obtain pension from commercial pension insurance after payment of pension contributions for 15 years consecutively. Housework undertaken by housewives is of value but is not paid, and housewives are therefore financially dependent on their husbands and children. Consequently, most housewives can hardly obtain sufficient pension to guarantee their aged life. In China, many career women also have to continue housework, and the number of women giving up their jobs for the reason of housework is apparently larger than men who have done the same thing. In 2005, the composition of non-economic population in cities and towns that was not covered by the social security system included the population undertaking housework, of which women accounted for 61 percent and men for 9.6 percent. The work division that men generally go out to work for money and women stay at home taking care of their families will lead to the situation that many women cannot get pension when they become aged (National Bureau of Statistics of China, 2007).

The rural pension system has been brought into place step by step from 2009, and in August of the year (China State Council, 2009), the State Council started to promote a new-type of rural pension insurance across the nation, and the rural pension system will be fully established by 2020 by combining basic pension and personal accounts. That will help eliminate the difference between urban and rural pension systems, extend social pension to rural areas, and hence change the current situation that aged farmers have to depend on their own families to support their aged life. However, equalization of public service cannot be fully achieved simply through establishment of the rural social pension system and a significant gap will remain between urban and rural areas. The amount of basic pension in cities is much higher than that in the countryside. In urban areas, basic pension is equal to 20 percent of the prior year’s average salary of society, and taking Beijing as an example, the monthly basic pension amount is RMB 660 or so based on the average salary level of RMB 39,867 in 2007 (Bureau of Statisitcs of Beijing, 2008). Basic pension to farmers comes from central and local governmental subsidies and is RMB 85 per month aggregately. The amount of basic pension to urban citizens in Beijing is eight times the basic pension to farmers around China. In rural areas, women accounts for 65 percent of total farmers, which means that pension security to women will represent the lowest level and involve an extremely huge group of people. Gradually narrowing such gap should be considered as an important part of the design of the national pension policy.

Pension Difference Among Classes of Society and between Men and Women

In cities, employees fall into different classes, which can be divided into two, namely civilians and non-civilians, in the perspective of pension system design. Civilians need not pay any pension contributions as they are all paid by the government, which are neither affected by the market nor restricted by their employers, and are stable at all time. Accordingly, 6.5 million civilians in China constitute the class possessing the most guaranteed social pension. However, non-civilians and their employers have topay pension contributions, and the percent of pension contribution payable by them is not above eight percent, while the part payable by their employers is much higher and reaches 22 percent, far beyond the international average, i.e. 10 percent. According to provisions of the pension system (China State Council, 1995), a personal pension account cannot be established until the contribution percent reaches 11 percent. The system combining personal and employer’s contribution accounts is like a double- edged sword. On one hand, it can strengthen the social responsibility of enterprises for the provision of pension to individuals, which is reflected in pension contribution and can increase the amount of pension paid to individuals. On the other hand, it will also cause higher risk associated with the establishment of pension accounts, as a person cannot have his/her personal pension account if either him/her or his/her employer fails to pay pension contribution on time and in full amount or fails to reach the contribution percent of 11 percent, or he/she might be prevented from pension entitlement after he/she is 60 years old in the event of failure in pension contribution for five consecutive years as a result of any discontinuity of contribution.

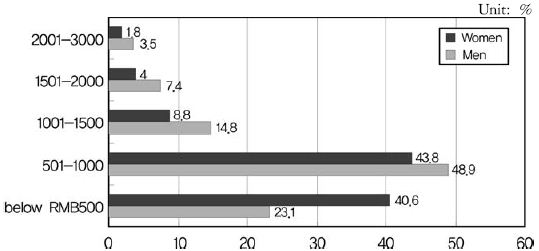

Generally, an individual qualified to pay pension contributions is required to have certain amounts of guaranteed income and employees whose income is excessively low often cannot afford such contributions. Income of employees in Chinese towns and cities appears to be a pyramid, only 0.9 percent of them earn over RMB 4,000, while the income of 32.85 percent is below RMB 500 and that of 46.35 percent is between RMB 1,000 and RMB 501.

RMB 500 is only enough to support one’s basic life, and income below RMB 1,000 can support a lease of cheap premises and basic transportation requirement and cannot also afford consideration of pension insurance for one’s aged life that is tens of years away from the present. Therefore, some people choose to waive participation in the insurance program. The percent of women in the population of low-income employees is much higher than that of men, and among employees with income below RMB 500, women and men respectively account for 40.6 percent and 23.4 percent, with the former being higher than the latter by nearly 17 percent.

Whether an enterprise pays pension contributions or not is dependent on three factors. First, it is directly related with the enterprise’s financial strength, as businesses on the edge of bankruptcy often cannot afford such contributions. Second, it depends on the personal quality and tradition of bosses of enterprises. In general, a boss not caring about his employees’ life will try whatever he can to reduce all costs and expenses in order to maximize his own benefit; but bosses of strong awareness of law compliance will pay such contributions according to applicable national regulations and ensure the rights and interests of employees. Third, it has something to do with the nature of an enterprise. Generally, enterprises of high technological content and high revenue and State-owned or State-held enterprises are more likely to guarantee legitimate rights and interests of their employees and take measures to prevent loss of technical personnel. Social security participation percents by industry show that the participation rate of State-owned and State-held enterprises is the highest, which reaches 48 percent and labor-intensive businesses of low revenue level and private enterprises are more likely to infringe employees’ reasonable benefits, which cannot even guarantee salary payment, let alone social security contributions. Sectors of employment of many women are largely private enterprises of low technological content, labor-intensive enterprises, and restaurant and hotels that are extremely unstable, etc.

Due to the reasons stated hereinabove, the percent of Chinese employees’ participation in social security is far from enough, which is only 50 percent. It means that half of employees cannot essentially enjoy pension under the employee-based pension system when they get aged and will thus be excluded from the pension system. Among them, female employees account for a very high percent of 60 percent which is above that of male employees by 20 percent (National Bureau of Statistics of China, 2007).

In addition, the amount of pension paid to civilians is also significantly different from that to non-civilians. The minimum pension amount to a civilian is equal to 80 percent of his/her pre-retirement salary, for instance, a civilian earning RMB 5,000 is entitled to pension in the amount of RMB 4,000. However, the pension amount of non-civilian is much less. A non-civilian also earning salary of RMB 5,000 can receive a pension amount of only RMB 1,800, which is less than half of that to civilians. It should be noted that China is currently reforming the social security and pension system among public utilities (including universities and colleges, Party schools, scientific research institutions, etc.) (China State Council, 2008), technical and professional staff of such utilities are stripped from the pension system of civilians and are included into the social security and pension system of non-civilians. The result is that the number of people entitled to civilian’s pension treatment will decrease significantly, which can mitigate the pressure on the national finance, while the population of the intermediate class included in the wholly-planned urban social security system will rise significantly, and the amount of pension to specialized technical employees will decline sharply. Along with that reform, the group of specialized technical employees in China will suffer “birth pangs,” and such “birth pangs” of female employees will be greater than those of male employees. Behind that are two reasons. One is that the percent of male civilians is higher than that of female civilians and 2/3 of civilians are men; more men will remain civilians and will thus be subject to less impact compared with women. Second, the percent of female specialized technical employees is higher than that of male, which is, for instance, 55.5 percent and 44.5 percent respectively in the educational sector, and 59.8 percent and 40.2 percent respectively in the health sector (National Bureau of Statistics of China, 2007). More women will be excluded from the pension treatment to civilians. As a responding strategy to minimize resistance, the State permits early retirement of specialized technical employees that have been in service for thirty years and provides them with the pension treatment to civilians. As a result, a group of female employees will retire early, and the percentage of women at specialized technical posts will thus be reduced.

Pension Difference among Official Ranks and between Men and Women

Based on division of social classes, civilians can be named as the class that enjoys the most guaranteed pension treatment among all social classes in China. However, the design of the pension system of civilians also shows obvious differences among official ranks and apparent sexual discrimination. Generally, the pension scheme of civilians is devised on the basis of two factors, namely official title and duration of service.

Civilians are administered on a section-based hierarchical system, which is applied to civilians almost in all countries, and to which China is not an exception. Civilians in China can be divided into four ranks, namely provincial department, prefectural departmental, county, and town levels, and there is a salary gap of RMB 2,000-3,000 between every two levels. Pension amount is closely linked with salary income, that is, the more salary income one earns, the more pension he/she will be entitled to, and vice versa. The entire section-based hierarchical system of civilians is in the shape of a pyramid, with the number of civilians ascending to the top and descending to the bottom of the pyramid. Women accounts for only 1/3 of total civilians, which is far below the percent of male civilians, and the percent of women at higher ranks is even lower. Therefore, the pension amount to female civilians will be much less than that to their male peers. Below is the gender composition of leaders and officials at various levels during the period from 2003 to 2006:

Duration of service is another criterion to determine the percent of pension payment to civilians, on the basis of which four percents are provided. First, governmental officials starting employment before the founding of the People’s Republic of China are entitled to pension equal to 100 percent of their salary income, and even additionally one to two months of their salary depending on the circumstances. Second, civilians who have been in service for more than 35 years are entitled to pension equal to 90 percent of their salary income. Third, civilians in service for 35 years can receive pension equal to 85 percent of their salary. Fourth, civilians in employment for 30 years are entitled to pension at the percent of 80 percent. Here, pension amount is closely linked with duration of service, and the longer the duration of service is, the more the pension will be, and vice versa.

It should be noted that mandatory gender-related restrictions are imposed on duration of service of civilians, resulting in the complex interweaving of the gender, service duration and official title factors. For instance, relevant national regulations provide that male and female civilians should retire respectively at 60 and 55. In practice, there are two situations. One is that the retiring age of female civilians above section- chief level may be extended to 60, which is equal to that of male civilians at the section-chief level. The other situation is that female civilians below the section-chief level must retire at 55, which is five years earlier than the retiring age applicable to male civilians inferior to section- chief level. Asa result, male and female civilians of the same educational level cannot enjoy equal pension treatment, which constitutes an obvious gender-based division of civilians and a brand of sexual discrimination (Liu & Jiang, 2003).

The gender-based pension gap is not only limited to civilians, but also naturally extended to specialized technical employees. Since the founding of the People’s Republic of China, the retirement provisions applicable to civilians have been adopted to specialized technical employees, which provide for five-year early retirement of female professional employees below the professor level. The result is that many female professors have involuntarily retired early, which has led to not only a decrease of their pension, but also to waste of a large number of female talents. As a result, sexual discrimination tends to escalate.

The gender-based pension gap is also shown among workers retiring from governmental authorities. Workers in enterprises receive different retirement treatment compared with their peers in public utilities, the former are included in the wholly-planned social security system, while the latter are entitled to retirement treatment applicable to public utilities, with male and female workers required to retire at 60 and 50 years respectively, showing a 10-year gap in retiring age between the two genders. It has become the pension system in the world that embodies the widest retiring age gap between male and female employees. As such, higher pension to men than to women is no longer an issue of personal quality of employees it is rather a mandatory system and arrangement. In that regard, female civilians and specialized technical employees have over ten years proposed to the National People’s Congress and to governmental authorities in charge that the retirement policy defining different retiring age for men and for women be amended, and that men and women be permitted to retire at the same age. Women’s federations around the nation also keep calling for that but none of them has succeeded. It has become a focal and difficult point of the effort to pursue policy equality between men and women in China.

Conclusion

The Chinese pension system was initiated earlier than most countries and was first started in cities. It was not devised on the basis of people’s fundamental rights and basic needs instead it was based on social class and identity, under which pension contributions were collected and pension payments were made, and that system, after several times of reforms, has been gradually extended from cities to rural areas in nearly half a century. It therefore contains extremely sharp gaps between urban and rural areas and among different social classes. Women are more likely to be excluded from the social security and pension system, and gender-related blind points exist in the design of the pension system with regard to the sharing of pension rights by men and women. More effort should be paid to evaluate the social effects of social policies and to conduct gender- based analysis, and decision-makers’ awareness of sensibility to gender should be strengthened.

The pension system in China adopts distinctively different standards for men and women, which fails to equally treat men and women in the same class and enables men to receive higher pension than women, thus resulting in broader pension gaps between men and women through such systematic arrangements. There are two reasons why such situations cannot be changed in a very long period of time. One is that women’s organizations have not established influence on social policies. The other reason is that the percentage of women in policymaking is insufficient to enable women to affect policymaking. Almost all members of policymakers are male officials in lack of gender-based perspective, who generally recognize the traditional concept concerning genders, and there is not enough shares for women to have their say and to affect the policymaking. It is imperative that women’s organizations cohere together to drive for the elimination of sexual discrimination in social policies through the path of power sharing and democratic participation.

References

- Bureau of Statisitcs of Beijing, (2008), Guan Yu Fa Bu 2007 Nian Bei Jing Shi Zhi Gong Ping Jun Gong Zi De Tong Gao[Announcement on the Publication of Average Income for Workers in Beijing in 2007], Bureau of Statisitcs of Beijing.

- China State Council, (1995), Guo Wu Yuan Guan Yu Shen Hua Qi Ye Zhi Gong Yang Lao Bao Xian Zhi Du Gai Ge De Tong Zhi [Notes on Further the Reform of Pension System for Enterprise Workers by China State Council], China State Council.

- China State Council, (2008), Guo Wu Yuan Guan Yu Yin Fa Shi Ye Dan Wei Gong Zuo Ren Yuan Yang Lao Bao Xian Zhi Du Gai Ge Shi Dian Fang An De Tong Zhi [Note on the Publishing of Pilot Proposal for the Reform of Pension System for Staff in Institutions by China State Council], China State Council.

- China State Council, (2009), Guo Wu Yuan Guan Yu Kai Zhan Xin Xing Nong Cun She Hui Yang Lao Bao Xian Shi Dian De Zhi Dao Yi Jian [Guidelines on Developing Pilot sites for New Pattern Social Pension System in Rural Areas by State Council], China State Council.

- Liu, J., & Jiang, Y. P, (2003), Guan Yu Nan Nv Gong Wu Yuan Tong Ling Tui Xiu Wen Ti De Tao Lun [Discussion on Same Retire Age for Men and Women Public Servant], Collection of Women's Studies, 11, p27-33.

- National Bureau of Statistics of China, (2007), Zhong Guo She Hui Zhong De Nv Ren He Nan Ren-Shi Shi He Shu Ju 2007 [Women and Men in Chinese Society-Facts and Figures 2007], National Bureau of Statistics of China.