Gender Differences of Asian College Students’ Financial Knowledge Pathways

We examined the financial knowledge pathways to their money management awareness attitude, behavior and outcome among the Asian college students and also try to analyze gender differences. The result was shown, basically, financial knowledge affects attitude and attitude affects behavior which affects outcome. However, we found that there exist gender differences in the financial knowledge pathways. These results can provide some applications on financial education.

Keywords:

Financial knowledge, financial knowledge pathways, gender differencesIntroduction

What is the reason for gender differences in financial well-being between men and women? This is an issue that researchers in many fields have tried to examine. Hira and Mugenda (2000) examined a variety of factors and showed that an average man’s level of financial well-being is higher than an average woman’s. Financial well-being results from a variety of components, and financial knowledge can be one of them (Garman et al., 1999; Joo, 2008; Rutherford & Wanda, 2010). Robb and Woodyard (2011) have asserted that while this knowledge is an important factor, there is uncertainty about what the impact is. Although some authors have concluded that a high level of financial knowledge is closely related to positive financial behavior (Chang & Hanna, 1992; Perry & Morris, 2005; Almenberg & Dreberb, 2011), some researchers have recently concluded that it does not directly cause changes to financial behavior and automatically improve financial well-being (Braunstein & Welch, 2002; de Meza et al., 2008; Mandell, 2006; Benartzi & Thaler, 2007).

Thus, one must ask if there are gender differences in financial knowledge. In most of the previous research, it was commonly argued that there exists an obvious gender difference in one’s attitude towards risk (Powell & Ansic, 1997; Bernasek & Shwiff, 2001; Yao & Hanna, 2005; Fehr-Duda et al., 2006), and a man’s level of financial knowledge has been demonstrated to be higher than a woman’s (Goldsmith & Goldsmith, 1997; Lusardi & Mitchell, 2011; Knoll & Houts, 2012). Furthermore, despite the fact that most educational programs provide the same financial education to students regardless of their gender, there has been little research on whether financial education has an equivalent effect on male and female students. According to Scott (2010), a lack of financial knowledge can be remedied with hands-on education, which should result in more effective financial decision-making (Robb & Woodyard, 2011).

On the other hand, many survey results, such as the OECD’s reports, have also revealed gender differences in economic factors which had been considered explicit variables in the literature (OECD, 2013a). Some researchers have found that financial knowledge is positively correlated with personal income and education level (Hilgert & Hogarth, 2002; Perry & Morris, 2005); higher levels of education tend to lead to a higher level of income. But according to Trostel, Walker, and Woolley (2002), education can have a larger impact on women than men, and therefore with higher competency women should play a greater role in the labor market.

An interesting situation exists in Korea, which has the largest proportion of women with higher education degrees among OECD member countries (OECD, 2013b). Korea’s gender-based income gap is more than double the average of the gap in OECD member countries (OECD, 2013a). Considering that Korea’s tertiary education completion rate of 64% is the highest in OECD countries (OECD, 2013b), the income inequality between the sexes is exceptional. And a similar situation can be found in China, where the All-China Women’s Federation reported that even if women’s education levels and social participation rates were improved, the income gap would remain high (China Pictorial Korean Edition, 2013). Such a case seems to indicate that higher educational attainment is insufficient to reduce the gender gap in financial status (Bertrand et al., 2010), and it must therefore be another way for women with higher education to improve their financial well-being. A better understanding of gender differences in money management in Korea and China may provide insights into whether financial education at an early stage of life can help young women learn better money management skills before beginning their economic activities.

It is important to focus on the period in which young people have financial experiences before they achieve financial independence, because this period may be the best time to change the economic status of adult women through financial education. Arnnet (2000) suggested that “emerging adulthood” is distinguished from adolescence or adulthood, and it is worthwhile to focus on this stage in the analysis of financial education for two reasons: (1) emerging adulthood is the best period to prepare the foundations of financial well-being, and (2) the economic factors which affect financial well-being are controlled for in terms of earnings, etc. Our focus on college students connects with Arnnet’s discussion. Many people at this stage go to college because young people need to accumulate knowledge and skills in preparation for their financial independence. Accordingly, there are many studies that surveyed college students (e.g., Hayhoe et al., 2005; Mandell, 2009; Shim et al., 2010; Sohn et al., 2012; Cude et al., 2013). Therefore, this study will also use surveys of college students for the reasons discussed above.

Based on the premise that financial education is the main influential factor on financial knowledge, the objective of this article is to examine how financial knowledge affects financial attitude and behavior among university students in Asian countries. This article focuses especially on gender differences in the pathways of financial knowledge, which will provide relevant implications for financial education and policy directions for Asian women’s financial well-being. It will therefore provide important information to address the gender gap by identifying factors that influence financial knowledge as well as looking at how one learns attitude and behavior related to money management.

Literature Review

Financial Knowledge, Financial Literacy, and Financial Education

Many definitions of financial literacy exist. But according to the definition of the U.S. Department of Treasury (2008), financial literacy means the ability to make informed judgments and to take effective actions regarding the current and future management of money. Moore (2003) regarded financial literacy as a broad concept that includes financial experience. Huston (2010) added self-confidence to the scope of financial literacy. More recently, Knoll and Houts (2012) classified financial literacy into the components of financial knowledge and financial skill. All of these studies, however, recognize that financial knowledge is a component of financial literacy.

The distinction between financial literacy and financial knowledge has not been clear until recently. Huston (2010) analyzed previous papers in which financial literacy was defined and concluded that more than 70% of the papers did not clarify the concept of financial literacy. We will follow the practice of many previous researchers and focus on financial knowledge as a component of financial literacy, although we realize that financial literacy should include more than just financial knowledge.

Although many countries emphasize the importance of financial literacy through education, there exist some limitations on evaluating and measuring it. Researchers have not found convincing evidence that financial education improves financial behavior and capability (de Meza et al., 2008; Mandell, 2006; Benartzi & Thaler, 2007). Cude et al. (2013) suggested that it is important to evaluate not only the effects of financial education on knowledge, attitude, and behavior but also the effects of financial education on the joint changes in these factors. Thus, researchers such as Knoll and Houts (2012) have tried various approaches to measuring financial knowledge. Many of the studies relating to financial knowledge used the questionnaire suggested by the Jump$tart (e.g., Mandell, 2009; Sohn et al., 2012).

Components of Knowledge and Their Correlations

Much of the previous literature in consumer studies classifies the types of knowledge into subjective knowledge, objective knowledge, and product experience (Brucks, 1986; Park et al., 1992; Raju et al., 1995). Objective knowledge indicates how accurately consumers remember information about a product (Bettman & Park, 1980), and subjective knowledge represents the extent to which consumers believe that they are aware of a product (Brucks, 1986; Rao & Monroe, 1988). Some studies suggest that subjective knowledge relates to a consumer’s self-confidence rather than to actual knowledge in making a decision, and objective knowledge is a consumer’s ability related to a product. Thus, the two types of knowledge should be considered separately (Brucks, 1985; Selnes & Gronhaug, 1986).

Carlson, Vincent, Hardesty, and Bearden (2009) reported their meta-analysis on other researchers’ studies about the link between objective and subjective knowledge, and they found many different conclusions. Some argued that objective knowledge affects subjective knowledge (Radecki & Jaccard, 1995; Park & You, 2007, Hadar et al., 2013), but others maintained that there is no relationship between the two (Ellen, 1994; Raju et al., 1995; Radecki & Jaccard, 1995). Park et al. (1994) suggested that product experience is one of the factors to knowledge, and it is more closely related to subjective knowledge than to objective knowledge.

To ascertain the pathways of financial knowledge, this study classified financial knowledge into subjective knowledge and objective knowledge, and it tested the effect of financial experience on these two types of financial knowledge.

Financial Knowledge Pathways

According to the rational behavior theory of Ajzen and Fishbein (1973), behavior is induced by intention, which is a function of subjective norms concerning attitude and outcome. Since the theory was first proposed, there has been an abundance of research on consumers’ attitude and behavior. This theory can be applied to financial decision- making and financial behavior.

Concerning the relationship between financial knowledge and financial behavior, Bernheim, Garrett, and Maki (2001) argued that financial knowledge is significantly related to financial behavior. Hilgert et al. (2003) found that financial knowledge is positively related to financial behaviors and financial outcomes. Also, Chang and Hanna (1992) found that individuals with high levels of financial knowledge made more efficient decisions when compared with those possessing low levels of financial knowledge. Hadar et al. (2013) suggested that attempting to increase objective knowledge regarding financial instruments can be diminished subjective knowledge, and also found these knowledges can affect willingness of investment. All of these studies show that financial knowledge positively affects financial behaviors and outcomes.

In the literature on the pathways of financial knowledge, Courchane and Zorn (2005) divided the pathway into three steps, including financial knowledge, financial behavior, and financial performance, ascertaining their sequential effects. Shim et al. (2009) proposed the student financial well-being model, and their empirical analysis showed that the effect of financial knowledge on financial behavior is relatively small, while the effect of financial attitudes on financial behavioral intention is large.

Gender Differences in Financial Knowledge

Concerning gender differences in financial knowledge and financial literacy, Webster and Ellis (1996) reported that women have a lower level of self-confidence in financial analytical matters than men on average. Other researchers reported similar results (Lytton & Grable, 1997; Prince, 1993). As for objective financial knowledge, Lusardi and Mitchell (2011) found gender differences in financial decision-making, which implies that women are typically less financially literate than men. Similarly, Goldsmith and Goldsmith (1997) reported that women’s financial literacy level is lower than men’s, and women have a lower level of self-confidence in mathematics and science than men. Based on these studies, women tend to have a lower level of subjective and objective knowledge than men.

Chen and Volpe (2002) surveyed university students and argued that there exists a gender gap in financial literacy even after controlling for other related variables. Using path analysis, Hayhoe et al. (2005) conclude that there are gender differences in financial attitudes, financial behaviors, and financial performance. According to previous studies, there are gender gaps in financial knowledge, attitudes, and behaviors. This study will examine the pathways of financial knowledge to financial attitude, behavior, and outcome and whether there are gender differences in the pathways. This study will also ascertain whether women have a lower level of financial knowledge than men, and we will focus on the gender differences in financial knowledge pathways.

Methods

Hypotheses

We established the following hypotheses based on previous literature:

H1: Financial experiences positively affect financial knowledge.

H1-1: Financial experiences positively affect objective knowledge.

H1-2: Financial experiences positively affect subjective knowledge.

H2: Objective knowledge positively affects subjective knowledge.

H3: Financial experiences positively affect financial knowledge pathways.

H3-1: Financial experiences positively affect financial attitude.

H3-2: Financial experiences positively affect financial behavior.

H3-3: Financial experiences positively affect financial outcome.

H4: Financial knowledge positively affects financial knowledge pathways.

H4-1: Objective knowledge positively affects financial attitude.

H4-2: Objective knowledge positively affects financial behavior.

H4-3: Objective knowledge positively affects financial outcome.

H4-4: Subjective knowledge positively affects financial attitude.

H4-5: Subjective knowledge positively affects financial behavior.

H4-6: Subjective knowledge positively affects financial outcome.

H5: Financial attitude positively affects financial behavior.

H5-1: Financial attitude positively affects financial outcome.

H6: Financial behavior positively affects financial outcome.

H7: The influence of financial experiences on financial knowledge is more positive for men than for women.

H7-1: The influence of financial experiences on objective knowledge is more positive for men than women.

H7-2: The influence of financial experiences on subjective knowledge is more positive for men than women.

H8: The influence of objective knowledge on subjective knowledge is more positive for men than women.

H9: The influence of financial experiences on financial knowledge pathways is more positive for men than women.

H9-1: The influence of financial experiences on financial attitude is more positive for men than women.

H9-2: The influence of financial experiences on financial behavior is more positive for men than women.

H9-3: The influence of financial experiences on financial outcome is more positive for men than women.

H10: The influence of financial knowledge on financial knowledge pathways is more positive for men than women.

H10-1: The influence of objective knowledge on financial attitude is more positive for men than women.

H10-2: The influence of objective knowledge on financial behavior is more positive for men than women.

H10-3: The influence of objective knowledge on financial outcome is more positive for men than women.

H10-4: The influence of subjective knowledge on financial attitude is more positive for men than women.

H10-5: The influence of subjective knowledge on financial behavior is more positive for men than women.

H10-6: The influence of subjective knowledge on financial outcome is more positive for men than women.

H11: The influence of financial attitudes on financial behavior is more positive for men than women.

H11-1: The influence of financial attitudes on financial outcome is more positive for men than women.

H12: The influence of financial behavior on financial outcome is more positive for men than women.

Conceptual Model

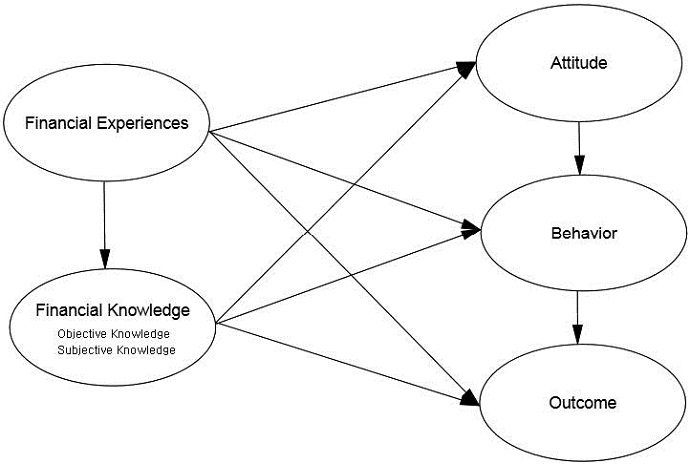

This study suggests the conceptual model described in Figure 1, in which the pathways of financial knowledge to financial behavior are established. We also examine gender differences in the pathways. According to previous research, knowledge can be divided into three types: subjective knowledge, objective knowledge, and experience. Thus, our goal is to ascertain the effects of the three factors on financial attitude, financial behavior, and financial outcome.

Data

To examine the pathways of financial knowledge and gender difference, this study surveyed university students who lived in large cities in Korea and China. The survey was conducted combined with pilot-test in May of 2013, and additional survey was conducted in October of 2013. It took one month each time. The questionnaire was designed on a self-reported basis and given in the respondent’s native language (Korean or Chinese). A total of 810 questionnaires were collected, and finally 716 questionnaires were used for analyses with a response rate of 88.4%, excluding inappropriate responses.

Measurement of Variables

First, objective financial knowledge was measured by the scores of the 30 questions, which were chosen from the questionnaire suggested by the Financial Supervisory Service (FSS) of Korea. Based on the questionnaire developed by the Jump$tart coalition in the US, the FSS questionnaire was reorganized in order to measure the financial literacy of Korean university students. The questionnaire for this study consisted of five sections: income (6), expenditure (6), savings (6), money management (6), and debt and credit (6). Second, subjective financial knowledge was measured by the self-evaluation scores (5 point Likert scale) of financial knowledge. Third, financial experience was measured by whether or not the respondent had experienced a transaction with each financial instrument. In exploring the questions of financial knowledge pathways, this paper will be limited to a consideration of these very narrow concepts. The other three variables were financial attitude, financial behavior, and financial outcome, measured by the self-evaluation scores (5 point Likert scale) of the questions related to money management. According to Xiao (2008), financial behavior can be defined by all kinds of activities related to money management, and he confined its contribution only to financial outcome. We have focused on financial area with money management, in particular, in order to clearly demonstrate our research. The summary of variables used in this study is shown in Table 1.

Analytical Methods

We used descriptive statistics to describe the sample characteristics. The data were analyzed using SPSS version 18.0. To examine gender differences in the pathways, the multiple group path analysis and confirmatory factor analysis are performed using AMOS version 20.0. Path analysis is a form of multiple regression focusing on causality. It is a useful statistical method to describe the dependencies among a set of variables. This analysis is appropriate because the purpose of this study is to examine the financial knowledge pathway’s causality.

Results

General Characteristics of the Sample

The general characteristics of the sample are shown in Table 2. Among 716 students, 370 (51.7%) were male and 346 (48.3%) were female. There were 449 Chinese students (62.7%) and 267 Korean students (37.3%). Most students (79%) had a bank account and 74% of students had a debit card. Only 39% held term deposits, 32% held fund investments, and 27% invested directly in stock shares. The objective financial knowledge score was 56.6% on average, with a savings score of 60.8%, money management score of 55.5%, expenditure score of 50.5%, debt score of 56.3%, and income score of 60.0%.

Gender Differences in Financial Factors

Table 2 reports the means and standard deviations of the financial factors by gender. Concerning objective financial knowledge, the average male student score was significantly higher than the average female student score. The gap was most significant in knowledge related to savings levels, while differences in other topics were not significant at 5% using a 2-tail test. There was not, however, a significant gender difference in subjective financial knowledge. Relative to female students, male students had significantly higher levels of financial experience with savings, funds, and stocks, but they had lower levels of financial experience related to debit cards. Female students had significantly higher money management attitude scores, but they were not significantly different from male students in money management behavior and money management outcome. These results can be interpreted as the situations that gender differences are not consistent. That is, male students have a higher score than female students in some cause variables, while female students have a higher score than male students in some intermediary variables. There are no differences in behavior and outcome variables. Thus, based on these results, it may be possible to ascertain the pathway from the cause variables to outcome variables and to examine the roles of intermediary variables.

Proposed Financial Knowledge Path Model

To analyze the pathways from financial knowledge to financial behavior, it is necessary to perform a correlation analysis, shown in Table 3. Except for the financial experience variable, all other variables satisfied the normality conditions in terms of skewness (≤3) and kurtosis (≤10). Thus the Pearson correlation coefficients were computed for these variables, and the Spearman correlation coefficients were computed for financial experience variables. The significant correlation coefficients supported the proposed pathways.

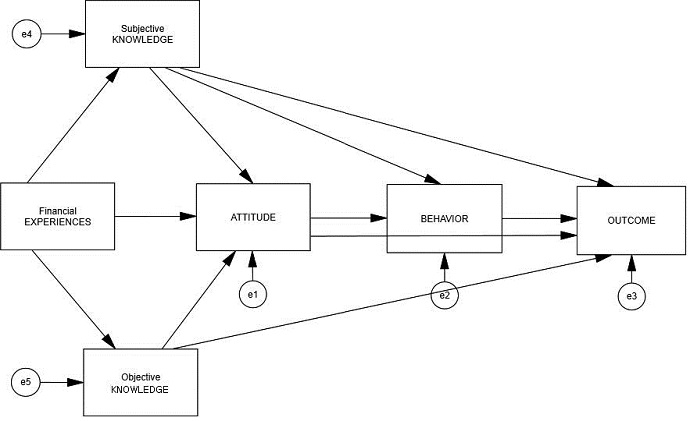

Based on previous research and the correlation results, the following path model in Figure 2 can be proposed. The effect of objective knowledge on financial behavior was not significant and the effects of financial experience on financial behavior and on outcome were not significant. Accordingly, these pathways were finally excluded in the model.

The validation of the proposed path model is shown in Table 3. The goodness of fit was x2 = 29.419 (df = 12, p = 0.003) of which p-value was not satisfactory. However, the x2 statistic is sensitive to the sample size. The statistic divided by the degree of freedom, x2/ df = 2.452, was less than the critical value. Therefore, it is concluded that the proposed path model is suitable for reflecting the reality. The results shown in Table 4 also support the suitability of the model.

Financial Knowledge Pathways

The results of analyzing the path model made it possible to test the hypotheses. First, the test results of H1 and H2 are presented in Table 5. The standardized total coefficient for H1-1 was 0.148, and the Critical Ratio (t-value) was 3.997. The coefficient for H1-2 was -0.140 with a Critical Ratio of -3.648, which led to rejection of the null hypothesis. That is, the students with higher financial experiences had higher objective knowledge but not higher subjective knowledge. On the other hand, the coefficient for H2 was -0.022 so we cannot reject the null hypothesis, which means that objective knowledge does not affect subjective knowledge. According to Park and Lessig (1981), subjective knowledge includes self-confidence, and there is therefore a possibility that respondents may have an excessive level of self-confidence.

Second, the test results of H3-6 are also presented in Table 5. Hypothesis 3 is about the pathways from financial experiences to attitude, behavior, and outcome related to money management awareness. The standardized total coefficient for H3-1 was 0.358 which led to the failure to reject the null. This means that financial experiences positively affect a students’ attitude toward money management awareness. H3-2 and H3-3, however, cannot be rejected, indicating that financial experiences only affect student’s attitude towards money management awareness, but it does not affect students’ behavior and outcome. Additionally, financial experiences indirectly affect behavior and outcoms through other factors.

Third, H4 concerns financial knowledge pathways and H4-1, H4-2, and H4-3 are related to financial objective knowledge. H4-4, H4-5, and H4-6 are about financial subjective knowledge. The statistical tests for H4-1 and H4-3 indicate a failure to reject the null hypothesis by the standardized total coefficients of 0.283 and -0.015, but H4-2 could not be rejected. These findings mean that students’ objective knowledge positively affects their attitude towards money management awareness and negatively affects their outcome but does not affect behavior. The result was similar to the effects of financial experiences on attitude. But the influence on outcome was very small (0.015), as the direct effect on outcome was negative (-0.136), and the indirect effect was positive (0.121). In the end the net effect was small.

Another hypothesis within H4 related to subjective knowledge. As the standardized total efficient for H4-4, H4-5, and H4-6 were -0.174, 0.080, and -0.138, the null hypotheses for these hypotheses could not be rejected. Therefore, student’s financial subjective knowledge levels negatively affect their attitude and outcoms but positively affect their behavior related to money management. However, the magnitude of the influence on behavior is very small.

Fourth, H5 involves attitude pathways, and H6 concerns the relationship between behavior and outcome. We can show that all paths are statistically significant by the standardized total coefficients of 0.348, 0.395, and 0.120. Therefore, students’ financial attitude towards money management awareness positively affects both behavior and outcome. Additionally, financial attitude has a significant influence on behavior and outcome towards money management awareness with respect to other factors.

Financial Knowledge Path Analysis by Gender

The remaining hypotheses are related to gender differences in the financial knowledge path model. The results of the multiple group path analysis can yield a test statistic for the hypotheses. Furthermore, a confirmatory factor analysis is necessary to verify that the two gender groups have the same structure. The results of the confirmatory factor analysis are shown in Table 6.

There was a significant difference between Model 1 and Model 2. If the values of constrained and unconstrained models are statistically significant, the structural invariances of the two models are different from each other (Byrne, 2010), which means there are structural differences in financial knowledge pathways towards financial outcome between male students and female students. Thus, it is pointless to compare the influence of gender differences in the same model. It is better to simply compare each group’s outline of the path. This research area requires further study.

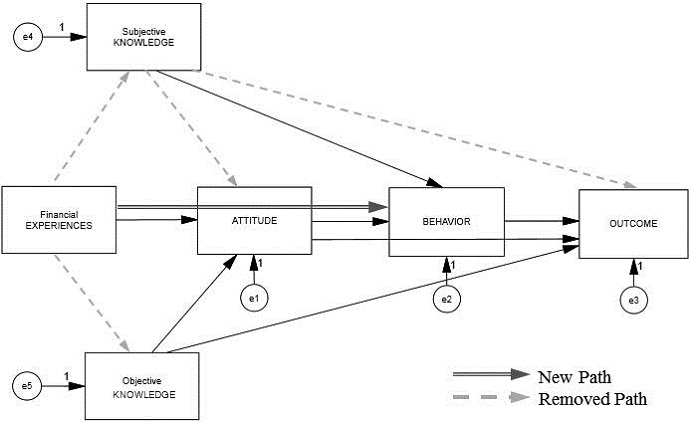

The revised path models for male and female groups are described in Figure 3 and Figure 4, respectively. The figures straightforwardly convey the differences in the pathways of financial knowledge between both gender groups.

Gender Differences in Financial Knowledge Pathways

There was a significant difference between Model 1 and Model 2. If the values of constrained and unconstrained models are statistically significant, the structural invariances of the two models are different from each other (Byrne, 2010). There are structural differences in financial knowledge pathways towards financial outcome between male students and female students, and it is not valid to compare the gender differences of effects in the same model. Therefore, we can only try to compare each group’s outline of the path.

The revised path models for male and female groups are described in Figure 3 and Figure 4, respectively. The figures straightforwardly convey the difference in the pathways of financial knowledge between the two gender groups. We could not examine the multi-group path analysis. We also cannot test hypotheses H7 through H12. However, we already identified the path model for the combined model. We can therefore consider an alternative way to examine the gender differences in financial knowledge pathways, which are based on a path model for the combined group. The results are presented in Table 7.

First, H7 is related to gender differences for the pathway of financial experiences through financial knowledge. In the combined model, financial experiences affected both objective and subjective knowledge (H1), but in the model for males only, we could not reject the null hypotheses. On the other hand, there are significant paths (H1-1 and H1-2) in the model for females, as in the combined model, and there is one additional path. While H2 in the combined model was statistically insignificant, in the model for females H8 was -0.122 and the Critical Ratio was -2.296, which led to failure to reject the null hypothesis. These results suggest that male students’ financial experiences did not affect either type of knowledge, while female financial experiences did improve their objective knowledge but had a negative impact on subjective knowledge. Additionally, objective knowledge had negative effects on subjective knowledge for female students.

Second, H9 is related to gender differences in financial experience pathways. The pathway from financial experiences to financial attitude was statistically significant for both men and women. In the male student group, however, there is an additional path that proceeds from financial experiences to financial behavior. This path is not significant with the female student group.

Third, H10 relates to gender differences in financial knowledge pathways. In the combined model, there are five financial knowledge paths. For the male group, objective financial knowledge affected attitude and outcome independently of subjective financial knowledge. Subjective financial knowledge affected behavior independently of objective financial knowledge. In the male group, objective knowledge affected attitude and outcome, but subjective knowledge did not affect attitude and outcome. In the female group, objective knowledge affected behavior but not outcome. In contrast to these patterns, there was an inverse relationship between the two types of financial knowledge in the female group. That is, female students with a higher level of objective financial knowledge tended to have a lower level of subjective financial knowledge and vice versa. While objective knowledge had a positive effect only on attitude, subjective knowledge had a negative effect on attitude and outcome as well as a positive effect on behavior. Based on these patterns, objective financial knowledge and subjective financial knowledge effects are different between males and females.

Fourth, H11 concerns gender differences of financial attitude pathways, and H12 is about gender differences in the relationship between behavior and outcome. In the combined model, attitude towards money management awareness had a significant effect on both behavior for money management and outcome for money management, and behavior also affected outcome. Similarly, in the male student model, attitude towards money management awareness had a significant effect on behavior for money management awareness (0.439) and outcome for money management, and behavior affected outcome. In the female student model, attitude had a significant effect on behavior and outcome, whereas behavior did not affect outcome. This implies that for female students the formation of a positive attitude through financial education may result in behavioral enhancement, but it might not extend to outcome.

To sum up, the male and female student groups had different financial knowledge pathways. That is, financial knowledge was framed based on financial experiences in the female student group, while financial knowledge and experiences are formed separately from each other in the male student group. In addition, in both groups a higher level of financial knowledge can improve money management attitude and behavior. It is noteworthy that positive behavior of male students tended to improve outcome, while positive behavior of female students had less of an influence on outcome, which is another indication of gender differences. Lastly, there were various pathways to improve behavior in the male student group other than through attitude, while the only pathway to improve behavior in the female student group was through attitude.

Discussion

Based on the literature, we expected to find gender differences in financial knowledge pathways. The purpose of this study was to discover ways to decrease the gender gap in financial outcome through the improvement of women’s financial knowledge. We discovered, however, that there are significant differences in the structure of financial knowledge pathways between male and female student groups. These results have important implications even when designing an educational program for men or women or when developing an innovative and specific learning method in classes that include both genders. Given that de Meza et al. (2008) stated that effective financial education should be able to change not only related knowledge but behavior as well, the major findings of this study should provide useful information for designing constructive financial education models. To the extent that male and female students receive financial education separately, we are able to provide some policy implications for financial education, though in universities where the financial education classes are offered to mixed classes of males and females, it might be more challenging to apply the results of this study.

Our analyses of financial knowledge pathways showed that financial knowledge affected attitude toward money management awareness, and attitude affected behavior for money management awareness, which affected money management outcome. Our results that financial experience and objective financial knowledge can enhance attitude are consistent with the results in the literature we reviewed. In this study, desirable attitude had a direct and positive effect on behavior, and financial experiences had an indirect and positive effect on behavior. Although it is not clear that financial knowledge induces a change in financial behavior, the finding implies that financial knowledge can change behavior through the mediation of financial attitude. Some researchers have argued that there is no evidence that financial education can change individuals’ behavior. Based on our research, such an argument should be reconsidered to find indirect paths to improving behavior.

However, one new issue concerns the possible negative effects of objective and subjective financial knowledge in the pathway to outcome. The direct effect of objective financial knowledge on outcome was negative, while its indirect effect was positive. Moreover, the magnitudes of the two effects were similar. Thus, after the opposite effects are canceled out, the effect of objective financial knowledge on outcome appeared to be negligible. Nonetheless, the effects of financial knowledge on behavior and outcome had a large absolute value, and therefore the importance of financial education for knowledge should not be underestimated.

Subjective financial knowledge turned out to have negative effects on attitude and outcome, which can be explained in relation to financial self-confidence from the literature. That is, excessive self-confidence in financial knowledge negatively affects attitude towards money management awareness and consequently has a negative effect on outcome of money management awareness. The effects of subjective financial knowledge were not remarkable, but it is interesting that subjective financial knowledge has a positive effect on behavior for money management awareness. This remains an area for further research.

Another important issue is gender differences in the financial knowledge pathways. We can conclude from our results that there is a gender difference in financial knowledge pathways, which implies that it might be more effective to design different financial education programs for males and for females.

We found that female students with higher levels of financial experience and objective financial knowledge had lower levels of subjective financial knowledge, which implies that an accumulation of financial knowledge tends to make female students underestimate their knowledge. In contrast, we could not find any factors that significantly affected subjective financial knowledge in the male student group. Therefore, we suggest that financial education for female students should be designed with a careful consideration of subjective knowledge, including aspects of self-confidence.

Considering the effectiveness of different types of educational methods, such as experience-based education, the pathways of financial knowledge and financial experience are crucial to designing financial education. From these results, the enhancement of financial knowledge affected behavior, but it is financial experience that directly affected outcome in the male student group. In contrast, enhancement of knowledge and accumulation of experience affected attitude but it was attitude that affected behavior and outcome in the female student group. We could not ascertain why personal financial experiences had less of an impact for women than for men, which is another topic for further research. One implication of our results is that financial education for female students should focus on the formation of positive attitude. In addition, subjective financial knowledge played a role in affecting attitude, behavior, and outcome in the female student group. Thus, the role of subjective financial knowledge also remains an issue for further research.

These tentative conclusions await further refinement and correction in further research since we have some limitations in this study. First, to reach a fuller understanding of the financial area we need to extend range of variables such as more nationalities and extension to other financial areas. Second, we need to analyse including additional factors such as cultural factors and consumer's socialization. Third, our result showed that there are structural differences in financial knowledge pathways between male and female. This means we suggest that further studies on different scale assessments are needed.

In spite of these limitations, we would like to close the discussion by point out some financial educational implications. In the context of effective financial education, the gender differences in financial knowledge pathways should be carefully considered. Since finance is closely related to everyday life, the importance of finance cannot be overemphasized. College students, in particular, should obtain the foundations of financial wellbeing for the future, and this may be more important for women than for men. Issues like the effects of subjective knowledge on financial outcome and the differential impacts on financial experiences by gender remain unresolved and should be addressed by future research. Nevertheless, the findings of this study will be applicable to designing effective financial education and reducing the gender gap problem at the important stage of emerging adulthood.

References

-

Ajzen, I., & Fishbein, M., (1973), Attitudinal and normative variables as predictors of specific behavior, Journal of personality and Social Psychology, 27(1), p1-41.

[https://doi.org/10.1037/h0034440]

-

Almenberg, J., & Dreberb, A., (2011), Gender, financial literacy and stock market participation, SSE/EFI Working Paper Series in Economics and Finance No. 737, Stockholm, Sweden: Economic Research Institute (EFI).

[https://doi.org/10.2139/ssrn.1880909]

-

Arnnet, J. J., (2000), Emerging Adulthood: A theory of development from the late teens through the twenties, Journal of American Psychologist, 55(5), p469-480.

[https://doi.org/10.1037//0003-066X.55.5.469]

-

Benartzi, S., & Thaler, R. H., (2007), Heuristics and biases in retirement savings behavior, Journal of Economic Perspectives, 21(3), p81-104.

[https://doi.org/10.1257/jep.21.3.81]

- Bernasek, A., & Shwiff, S., (2001), Gender, risk, and retirement, Journal of Economic Issues, 35(2), p345-356.

- Bernheim, D., Garrett, D., & Maki, D., (2001), Education and Saving: The long-term effects of high school financial curriculum mandates, Journal of Public Economics, 80(3), p435-465.

-

Bertrand, M., Goldin, C., & Katz, L. F., (2010), Dynamics of the Gender Gap for Young Professionals in the Financial and Corporate Sectors, American Economic Journal: Applied Economics, 2(3), p228-255.

[https://doi.org/10.1257/app.2.3.228]

-

Bettman, J. R., & Park, C. W., (1980), Effect of prior knowledge and experience and phase of the choice process on consumer decision processes: A protocol analysis, Journal of Consumer Research, 7(3), p234-248.

[https://doi.org/10.1086/208812]

- Braunstein, S., & Welch, C., (2002), Financial literacy: An overview of practice, research, and policy, Federal Reserve Bulletin, p445-457.

-

Brucks, M., (1985), The effects of product class knowledge on information search behavior, Journal of Consumer Research, 12(1), p1-16.

[https://doi.org/10.1086/209031]

- Brucks, M., (1986), A typology of consumer knowledge content, Advances in Consumer Research, 13(1), p58-63.

- Byrne, B. M., (2010), Structural equation modeling with AMOS: Basic concepts, applications, and programming (2nd ed.), New York, NY: Taylor & Francis Group.

-

Carlson, J., Vincent, I. H., Hardesty, D. M., & Bearden, W. O., (2009), Objective and subjective knowledge relationships: A quantitative analysis of consumer research findings, Journal of Consumer Research, 35(5), p864-876.

[https://doi.org/10.1086/593688]

-

Chang, R., & Hanna, S., (1992), Consumer credit search behavior, Journal of Consumer Studies and Home Economics, 16(1), p207-227.

[https://doi.org/10.1111/j.1470-6431.1992.tb00513.x]

- Chen, H., & Volpe, R.P., (2002), Gender differences in personal financial literacy among college students, Financial Services Review, 11(3), p289-307.

- China Pictorial Korean Edition, (2013), Survey on Chinese Women’s Social Status, Retrieved February 25, 2013, from http://chinacorea.com/new.php?class=123.

- Courchane, M. J., & Zorn, P. M., (2005), Consumer literacy and creditworthiness, Federal Reserve System Conference, Promises and Pitfalls: as consumer options multiply, who is being served and at what cost.

- Cude, B. J., Kunovskaya, I., Kabaci, M. J., & Henry, T., (2013), Assessing changes in the financial knowledge of college seniors, Consumer Interests Annual, 59, p1-17.

- De Meza, D., Irlenbusch, B., & Reyniers, D., (2008), Financial capability : A behavioural economics perspective, Canary Wharf, London : FSA(Financial Services Authority).

-

Ellen, P. S., (1994), Do we know what we need to know? Objective knowledge effects on pro-ecological behaviors, Journal of Business Research, 30(1), p43-52.

[https://doi.org/10.1016/0148-2963(94)90067-1]

-

Fehr-Duda, H., de Gennare, M., & Schubert, R., (2006), Gender, financial risk, and probability weights, Theory and Decision, 60(2/3), p283-313.

[https://doi.org/10.1007/s11238-005-4590-0]

- Garman, E.T., Kim, J., Kratzer, C.Y., Brunson, B. H., & Joo, S., (1999), Workplace financial education improves personal financial wellness, Journal of Financial Counseling and Planning, 10(1), p80-91.

-

Goldsmith, E., & Goldsmith, R. E., (1997), Gender differences in perceived and real knowledge of financial investments, Psychological Reports, 80(1), p236-238.

[https://doi.org/10.2466/PR0.80.1.236-238]

-

Hadar, L., Sood, S., & Fox, C. R., (2013), Subjective Knowledge in Consumer Financial Decisions, Journal of Marketing Research, 50(3), p303-316.

[https://doi.org/10.1509/jmr.10.0518]

-

Hayhoe, C. R., Leach, L. J., Turner, P. R., Bruin, M. J., & Lawrence, F. C., (2005), Differences in spending habits and credit use of college students, Journal of Consumer Affairs, 34(1), p113-133.

[https://doi.org/10.1111/j.1745-6606.2000.tb00087.x]

- Hilgert, M. A., & Hogarth, J. M., (2002), Financial knowledge, experience and learning preferences: preliminary results from a new survey on financial literacy, Consumer Interests Annual, 48(1), p1-7.

- Hilgert, M. A., Hogarth, J. M., & Beverly, S. G., (2003), Household financial management: The connection between knowledge and behavior, Federal Reserve Bulletin, 89(7), p7-14.

- Hira, T. K., & Mugenda, O., (2000), Gender differences in financial perceptions, behaviors and satisfaction, Journal of Financial Planning, 13(2), p86-92.

-

Huston, S. J., (2010), Measuring financial literacy, The Journal of Consumer Affairs, 44(2), p296-316.

[https://doi.org/10.1111/j.1745-6606.2010.01170.x]

-

Joo, S., (2008), Personal Financial Wellness, In J. J. Xiao (Ed.), Handbook of Consumer Finance Research (pp. 21-33), NY: Springer.

[https://doi.org/10.1007/978-0-387-75734-6_2]

-

Knoll, M. A. Z., & Houts, C. R., (2012), The financial knowledge scale: An application of Item Response Theory to the assessment of financial literacy, Journal of Consumer Affairs, 46(3), p381-410.

[https://doi.org/10.1111/j.1745-6606.2012.01241.x]

- Kline, R. B., (2005), Principles and Practice of Structural Equation Modeling(2nd ed.), New York: The Guilford Press.

-

Lusardi, A., & Mitchell, O., Cambridge, MA: National Bureau of Economic Research, (2011), Financial literacy and planning: Implication for retirement wellbeing (Working Paper No. 17078).

[https://doi.org/10.2139/ssrn.881847]

- Lytton, R., & Grable, J., (1997), A gender comparison of financial attitudes, Proceedings from the annual meeting of the Eastern Family Economics and Resource Management Association, p189-191.

- Mandell, L., (2006), The impact of financial literacy education on subsequent financial behavior, Unpublished manuscript, SUNY-Buffalo.

- Mandell, L., (2009), The Financial Literacy of Young American Adults: Results of the 2008 National Jump$tart Coalition Survey of High School Seniors and College Students, Jump$tart. Retrieved from http://www.jumpstart.org/assets/files/2008Survey Book.pdf.

- Moore, D., (2003), Survey of financial literacy in Washington State: Knowledge, behavior, attitudes, and experiences, (Technical Report 03-39), Washington State University, Social and Economic Sciences Research Center.

- OECD, (2013a), OECD Employment Outlook, Paris, OECD.

-

OECD, (2013a), Education at a Glance 2013: OECD Indicators, OECD Publishing. Retrieved from.

[https://doi.org/10.1787/eag-2013-en]

-

Park, C. W., & Lessig, V. P., (1981), Familiarity and its impact on consumer decision biases and heuristics, Journal of Consumer Research, 8(2), p223-231.

[https://doi.org/10.1086/208859]

- Park, C., Feick, W. L., & Mothersbaugh, D. L., (1992), Consumer knowledge assessment: How product experience and knowledge of brands, attributes, and features affects what we think we know, Advances in Consumer Research, 19(1), p193-197.

-

Park, C., Mothersbaugh, D., & Lawrence, F., (1994), Consumer knowledge assessment, Journal of Consumer Research, 21(1), p71-82.

[https://doi.org/10.1086/209383]

- Park, S., & You, S., (2007), A study of the effect of health motivation and environmental concern on choosing organic food, Korean Consumption Culture Association, 10(4), p107-126.

-

Perry, V. G., & Morris, M. D., (2005), Who is in control? The role of self-perception, knowledge and income in explaining consumer financial behavior, Journal of Consumer Affairs, 39(2), p299-313.

[https://doi.org/10.1111/j.1745-6606.2005.00016.x]

-

Powell, M., & Ansic, D., (1997), Gender differences in risk behaviour in financial decision-making: An experimental analysis, Journal of Economic Psychology, 18(6), p605-628.

[https://doi.org/10.1016/S0167-4870(97)00026-3]

-

Prince, M., Women, men and money styles, Journal of Economic Psychology, (1993), 14(1), p175-628.

[https://doi.org/10.1016/0167-4870(93)90045-M]

-

Radecki, C. M., (1995), Perceptions of knowledge, actual knowledge, and information search behavior, Journal of Experimental Social Psychology, 31(2), p107-138.

[https://doi.org/10.1006/jesp.1995.1006]

-

Raju, P. S., Lonial, S. C., & Mangold, W. G., (1995), Differential effects of subjective knowledge, objective knowledge and usage experience on decision making: An exploratory investigation, Journal of Consumer Psychology, 4(2), p153-180.

[https://doi.org/10.1207/s15327663jcp0402_04]

-

Rao, A, R., & Monroe, K. B., (1988), The moderating effect of prior knowledge on cue utilization in product evaluation, Journal of Consumer Research, 15(2), p253-264.

[https://doi.org/10.1086/209162]

- Robb, C. A., & Woodyard, A. S., (2011), Financial knowledge and best practice behavior, Journal of Financial Counseling & Planning, 22(1), p60-70.

-

Rutherford, L. G., Wanda, S. F., (2010), Financial wellness of young adults age 18-30, Family and Consumer Sciences Research Journal, 38(4), p468-484.

[https://doi.org/10.1111/j.1552-3934.2010.00039.x]

-

Scott, R. H., (2010), Credit card ownership among American high school seniors: 1997-2008, Journal of Family and Economic Issues, 31(2), p151-160.

[https://doi.org/10.1007/s10834-010-9182-7]

- Selnes, F., & Gronhaug, K., (1986), Subjective and objective measures of product knowledge contrasted, Advanced in Consumer Research, 13(1), p67-71.

-

Shim, S., Barber, B. L., Card, N. A., & Xiao, J. J., (2010), Financial socialization of first-year college students: The roles of parents, work, and education, Journal of Youth Adolescence, 39(12), p1457-1470.

[https://doi.org/10.1007/s10964-009-9432-x]

-

Shim, S., Xiao, J., Barber, B. L., & Lyons, A. C., (2009), Pathways to life success: A conceptual model of financial well-being for young adults, Journal of Applied Developmental Psychology, 30(6), p708-723.

[https://doi.org/10.1016/j.appdev.2009.02.003]

- Sohn, S., Joo, S., Grable, J., Lee, S., & Kim, M., (2012), Adolescents’ financial literacy: The role of financial socialization agents, financial experiences, and money attitudes in shaping financial literacy among South Korean youth, Journal of Adolescence, 35(4), p969-980.

-

Trostel, P., Walker, I., & Woolley, P., (2002), Estimates of the Economic Return to Schooling for 28 Countries, Labour Economics, 9(1), p1-16.

[https://doi.org/10.1016/S0927-5371(01)00052-5]

- U.S. Department of Treasury, (2008), Financial Literacy and Education Commission, Retrieved June 15, 2008, from www.MyMoney.gov.

-

Webster, R. L., & Ellis, T. S., (1996), Men's and Women's self-confidence in performing financial analysis, Psychological Reports, 79(3f), p1251-1254.

[https://doi.org/10.2466/pr0.1996.79.3f.1251]

-

Xiao, J. J., (2008), Handbook of Consumer Finance Research, New York: Springer.

[https://doi.org/10.1007/978-0-387-75734-6]

- Yao, R., & Hanna, S. D., (2005), The effect of gender and marital status on financial risk tolerance, Journal of Personal Finance, 4(1), p66-85.