Long-term Care Insurance and the Eldercare Workers’ Wages: The Case of South Korea

Abstract

This study investigates how the introduction of compulsory long-term care insurance has affected the wages of eldercare workers in South Korea. I obtained 94,457 observations from 12,600 employees using the Korean Labor and Income Panel Study data. Using a difference-in-differences approach, I compare eldercare workers with other workers in terms of their wage growth rates before and after the policy introduction. The evidence indicates that the policy increased the wages of eldercare workers. More interestingly, eldercare workers, mostly women aged 50 or older, are given lower wage returns for job experience than other occupations, and these returns have further decreased after the policy introduction. This study challenges the notion that welfare-state expansion guarantees women’s improved status at work and calls for more attention to care workers’ working conditions in the defamilialization of care.

Keywords:

Care, eldercare, gender, long-term care, welfare stateIntroduction

Defamilialization of care refers to “public policies that aim to reduce the care responsibility of the family” (Estévez-Abe & Naldini, 2016, p. 327). Over the past decades, its expansion has characterized social changes in many developed countries. Population aging, women’s increasing labor force participation, and “changing norms about family and kin responsibilities and the role of women” all play crucial roles in accelerating the defamilialization of care (Daly & Lewis, 2000, p. 288).

Major policy shifts in the defamilialization of care in South Korea (hereafter Korea) include universal free access to childcare, long-term care (LTC) insurance, and social service vouchers. These policies were introduced in the late 2000s or the early 2010s and have influenced care workers’ working conditions in various ways. Among these policies, LTC insurance is assumed to have the most significant impact on care workers’ conditions because of Korea’s rapid population aging and increasing number of beneficiaries. Since the introduction of LTC insurance in 2008, LTC workers have made up most of the eldercare workers in Korea.1

This study explores how the introduction of LTC insurance has affected the wages of eldercare workers in Korea, focusing on the wage consequences of this policy. Wages are the primary source of income for most people. Hence, they are a critical measure of working conditions and are associated with socioeconomic disparities among employees (Lee, 2010).

The influence of policies on eldercare workers’ wages holds considerable significance for feminist research and policy considerations. In Korea, the eldercare profession is predominantly undertaken by native women aged 50 or older.2 In this context, if the policy introduction influences the wages of eldercare workers, it can contribute to shaping socioeconomic disparities between other employee groups and older adult women workers. The latter represents one of the most disadvantaged groups in the Korean labor market.

The effects of LTC insurance on the working conditions of eldercare workers are multifaceted. On one hand, it is claimed that LTC insurance has created jobs and enhanced the condition of eldercare workers in Korea. Many LTC workers were outside the labor market before entering their occupations (Oh & Roh, 2010). Oh and Roh (2010) provide survey results showing that LTC workers’ conditions are better than those of caregivers3 who are directly employed by their patients and argue that the introduction of this policy has improved the conditions of eldercare workers.

However, there is evidence that LTC workers in Korea face precarious conditions. Their hourly wages are close to the minimum wage, which is pointed out as the most critical problem in their conditions (Chang, Kim, Lim, Kang, & Kim, 2010; Kuk & Ko, 2018; National Human Rights Commission of Korea, 2012; Shin et al., 2013). One reason for the low wages of LTC workers is that they are not rewarded for their job experiences. Although seniority-based wage benefits are available for LTC workers, their role in increasing wages remains minimal. The benefits are small and based only on tenure under the same employer, whereas LTC workers’ job security is relatively low (Kuk & Ko, 2018; National Human Rights Commission of Korea, 2022).

Only a few studies have investigated the effects of LTC insurance on the wages of eldercare workers in Korea, and most have relied on surveys or interviews with a small number of participants. Furthermore, they drew opposite conclusions using different groups to compare LTC workers. Oh and Roh (2010) compared LTC workers with caregivers and concluded that policy introduction increased wages for eldercare workers. In contrast, Cho, Lee, and Park (2013) and Peng (2010) compared LTC workers with social workers4 who provided care services at public nursing homes before the policy introduction and claimed that the policy introduction lowered eldercare workers’ wages.

To provide a more comprehensive understanding, I examined 94,457 observations of 12,600 employees over 23 years, from 1998 to 2020. The data were obtained from the Korean Labor and Income Panel Study (KLIPS). Using a difference-in-differences approach, I compare the wage growth of 428 eldercare workers with that of other 12,491 employees before and after the policy’s introduction in 2008. In addition, I examined the argument that eldercare workers are not rewarded for their job experience under LTC insurance. I investigate whether eldercare workers have penalties for their wage growth by tenure compared to other employees and whether these penalties increased after the policy introduction.

This study presented three main findings with various implications. I found that eldercare workers’ wages increased at a higher rate than those of other employees after the introduction of the policy. Furthermore, the results indicate that eldercare workers’ wage returns to tenure are lower than those of other employees, and these lower returns are exacerbated after policy introduction.

This study is one of the few endeavors to quantitatively evaluate the impact of defamilialization of care on the working conditions of care workers in Korea. Existing research has not paid sufficient attention to care workers’ conditions during the defamilialization of care in Korea. The conditions of care workers are significant not only in shaping the quality of their services, but also in upholding the dignity of frontline workers involved in the defamilialization of care.

The remainder of this paper is organized as follows. The next section reviews the literature on the relationship between welfare states and women’s paid labor as well as prior research on the effects of LTC insurance on the conditions of eldercare workers in Korea. The third section provides the institutional background of the policy and LTC workers in Korea. The Methods and Findings sections follow. The final section discusses the implications of the findings.

Literature Review

This study is grounded in Orloff’s (1996) view that welfare states and gender relationships are intertwined. In her view, gender relations concerning ideologies, political participation, and the division of labor can mold the characteristics of welfare states, while welfare states can also influence gender relations. In these “mutual effects of gender relations and welfare states” (Orloff, 1996, p. 73), the current study considers the relationship between welfare states and women’s paid labor.

There has been debate over whether welfare-state expansion can enhance women’s attainment in the labor market. On the one hand, the welfare state is assumed to facilitate women’s labor force participation by creating jobs and alleviating their care burden. However, it has been argued that welfare-state expansion cannot lead to a better status for women in the labor market. Although the expansion of welfare-state employment may help more women participate in paid labor, the average quality of their jobs may not match that of their male counterparts.

A major strand of research on the relationship between welfare states and women’s paid labor concerns the role of welfare states in improving women’s employment attainment. This line of thought notes that welfare states can increase women’s labor force participation by easing their difficulties with unpaid care. For instance, Swedish policies exemplify this role of welfare states, particularly because of their higher level of public childcare provision and support for paid work absences (Esping-Andersen, 1990; Morgan, 2005).

Another emancipatory potential of welfare states lies in their roles as employers. The expansion of social services creates public employment, especially in the health, education, and welfare industries, and this welfare-state employment can increase the demand for women’s paid labor. Studies have shown that women comprise a higher proportion of those employed by the welfare state than men and that this “feminization of the welfare state” (Esping-Andersen, 1990, p. 202) is more pronounced in Scandinavian countries (Esping-Andersen, 1990; Gornick & Jacobs, 1998; Huber & Stephens, 2000; Kolberg, 1991). Hagan (1991) adds that the expansion of welfare-state employment in Norway in the 1970s increased women’s labor force participation by employing homemakers.

Other studies have argued that welfare-state expansion can enhance women’s working conditions. For instance, Kolberg (1991) studies Sweden from 1965 to 1985, when its welfare-state employment dramatically expanded and finds that 65% of the increase in the number of women employees in professional, administrative, and technical occupations came from health, education, and welfare, industries closely related to welfare-state employment. According to him, this proportion is more than twice that of Swedish men and higher than the respective percentage of women in the United States. Based on this analysis, Kolberg (1991) contends that welfare states can improve women’s status in the labor market as well as provide them with jobs.

However, another strand of research proposes that welfare-state expansion may not guarantee women’s better status in the labor market. For example, Gornick and Jacobs (1998) indicate that Swedish women employees in the public sector, regarded as the primary beneficiaries of welfare-state employment, have a wage penalty compared to their private-sector counterparts. They further reveal that women employees’ wage penalties and women’s concentration in the public sector exacerbate the gender wage gap in Sweden. Similarly, Mandel and Semyonov (2005) note that the higher a country’s level of welfare-state intervention, the more likely that women will have female-type jobs and non-managerial positions. These notions align with Esping-Andersen’s (1990) finding that the level of women’s underrepresentation in professional and technical occupations is higher in Sweden than in Germany or the United States.

Disagreements on the role of the welfare state in women’s paid labor continue in studies of LTC insurance in Korea. Some have proposed that Korea’s compulsory LTC insurance has enhanced the conditions of eldercare workers and created employment opportunities, especially for older adult women outside the labor market. For instance, Oh and Roh (2010) noted that the policy improved eldercare workers’ conditions by formalizing their labor, mostly in the informal sector before policy introduction.

However, others argue that LTC insurance has worsened the working conditions of eldercare workers, partly because the new wage system under the policy no longer compensates for their job experiences. Studies supporting this claim address the downgrades in working conditions experienced by social workers who cared for patients in public nursing homes before the policy introduction (Cho et al., 2013; Peng, 2010). For these social workers, wage reduction was one of the most critical changes the policy brought about (Peng, 2010). This wage decline was partly attributed to changes in the wage structure, which caused them to no longer expect wage increases relative to their tenure (Cho et al., 2013; Peng, 2010).

The reduction in social workers’ wages may also be attributable to the policy’s predominant reliance on the private sector (for-profit and non-profit) for service delivery.5 This marketization of eldercare has been criticized for exacerbating the conditions of eldercare workers. This criticism stems from the profit-maximizing strategies employed by eldercare service providers and the oversupply of providers and workers (Chang et al., 2010; Seok, 2010; Shin et al., 2013). In this context, the introduction of the policy led to wage downgrades for social workers who transitioned from public to private providers to continue working as eldercare workers (Cho et al., 2013; Peng, 2010).

The current study investigates how the introduction of LTC insurance has influenced eldercare workers’ working conditions using wages as a measure of their conditions. While previous research has been chiefly based on studies involving few participants or comparison groups, this study analyzed 94,457 observations of 12,600 employees from official Korean data. Concerning the arguments that eldercare workers’ job experience has been disregarded in policy, this study explores whether they face wage penalties when considering their tenure. Thus, this study provides a comprehensive view of the working conditions of eldercare workers in Korea amid the defamilialization of care.

Institutional Background

In Korea, LTC insurance was introduced in 2008 for older adults needing assistance in their daily lives. The policy is proclaimed to support their well-being and alleviate their families’ care burdens. Compulsory insurance premiums are the primary source of funds, but the policy is also funded by tax subsidies and service–user co-payments. The government determines the eligibility for its services among Korean citizens aged over 64 years or under 65 years with geriatric illnesses. With the introduction of this policy, public eldercare services in Korea expanded their beneficiaries to all citizens, whereas they had previously centered on a select number of low-income patients.

Concurrently with this increase in beneficiaries, there has been a significant increase in the number of public eldercare service workers since the introduction of this policy. As of 2022, their total count has surged to 626,765, in contrast to the 37,684 recorded just before the policy was implemented (Heo, 2019; National Health Insurance Service, 2023). The paramount occupational category within this workforce is that of LTC workers.6 As primary direct care workers, their current number has reached 564,243, comprising 90% of the entire policy workforce (National Health Insurance Service, 2023). Unlike other informal eldercare professionals, their eligibility and training levels are subject to policy regulations.7

While LTC workers form the backbone of LTC in Korea, their employment conditions are more precarious than those of other workers. This vulnerability is evident in their lower rate of regular employment, making them more susceptible to job insecurity than other professions under the policy (Kang, Lee, Lim, Choo, & Bae, 2019). Furthermore, their hourly wages are the lowest among the policy’s major occupations (Kang et al., 2019).

LTC workers are predominantly older adult women (Ministry of Health and Welfare, 2019). This gender segregation might be related to Korean society’s norm of gendered division of labor, which may make service providers regard women as more suitable for the job or make them feel more comfortable applying for the occupation (England, Farkas, Kilbourne, & Dou, 1988). Although the policy partly alleviates the burden of eldercare on the family, it cannot change the condition that women are primary eldercare workers (Orloff, 1993). This gender segregation resembled the Scandinavian situation in the 1980s, which the feminist analysis of social policy called the “public patriarchy” (Daly & Lewis, 2000, p. 284).

Although Korea is not the only society in which most LTC workers are women, it is unique in the sense that the age of LTC workers is high. Among the 30 Organization for Economic Co-operation and Development (OECD) nations, the median age of these workers is the highest in Korea (OECD, 2020). Across OECD countries, LTC workers are paid relatively low; thus, this occupation may be filled by those with few other employment options (OECD, 2020). In some countries, immigrant women constitute an essential group of LTC workers. In Korea, native-born older adult women may belong to this group.

By service type, LTC workers in Korea are divided into “home” and “residential” care workers. Homecare workers, who comprise most LTC workers, visit patients’ homes to care for them. Residential care workers care for patients in nursing homes, ensuring a 24-hour service. LTC workers’ services center on personal patient care such as bathing, dressing, feeding, checking health conditions, and helping with urination and defecation. For homecare workers, domestic work such as cooking is added to their tasks.

These two categories of LTC workers differ not only in the nature of their services but also in their employment conditions. Regarding job security, homecare workers face even more precarious conditions than residential care workers (Nam, 2021). However, residential care workers spend more hours on round-the-clock services (Shin et al., 2013). Due to this disparity, while their average monthly wages surpass those of homecare workers, their hourly wages are lower (Nam, 2021; Shin et al., 2013).

Methods

Data and Sample

This study uses personal data from all 23 waves of the KLIPS. The KLIPS is an annual panel study of 5,000 households and their members aged over 14 years in Korean urban areas. It began its first wave in 1998 and completed its 23rd wave in 2020.

The KLIPS data are suitable for this study for several reasons. First, the data provide information on paid labor and detailed employee characteristics such as age, gender, and education. Second, ten or more waves are accessible from the KLIPS data for each period before and after 2008. For the purposes of this study, it is essential to have sufficient observations before and after the introduction of the policy. Finally, KLIPS is the only panel dataset that satisfies the above two requirements. Hence, I use individual and time-fixed effects to alleviate concerns about omitted variable bias.

This study analyzes 94,457 observations from 12,600 Korean employees. The number of observations of eldercare workers is 1,502, accounting for 1.6% of all observations. The total number of eldercare workers is 428.

Analytic Technique and Measurement

This study uses a difference-in-differences approach to identify the effects of LTC insurance on the wages of eldercare workers. The difference-in-differences estimates the impact of an exogenous shock on the group of interest by comparing its change before and after the shock with that of the other group, assuming the latter to be the counterfactual change in the treatment group in the absence of the shock. In this study’s framework, the shock is the Korean government’s adoption of LTC insurance in 2008. The treatment group is the eldercare workers, defined as those in the occupational category of “personal care workers”8in the Korean Standard Classification of Occupations (Statistics Korea, 2000a). It is likely to include most eldercare workers, although it may not exclusively consist of them. The control group comprised all the other employees in the data.

| Equation 1. |

Equation 1 shows the baseline specifications. Yit is the natural logarithm of real hourly wages; Xit is a group of control variables; αi is the individual fixed effect which absorbs stable, unmeasured individual characteristics that can affect Yit; αt is the time-fixed effect and controls for any yearly changes commonly experienced by individuals in the sample.

Three different exercises were performed using three key independent variables. First, to investigate the policy effects on eldercare workers’ wages in general, I use the interaction between the dummy variable for eldercare workers and that for the period after 2008. Second, I use the interaction between tenure and the dummy variable for eldercare workers to ascertain whether eldercare workers’ wage returns to tenure differ from those of other employees. Finally, I investigate the changes in wage returns to tenure after the policy introduction using the three-way interaction of tenure and dummy variables for eldercare workers and for the period after 2008.

The controls included sociodemographic variables such as age, gender (dummy variable for women), area of residence,9 years of formal education, marital status (dummy variable for being married except for separation), and its interaction with gender. I also control for employment type (dummy variable for regular workers), firm size (dummy variable for working either in a public firm or in a firm with more than 299 employees), union (dummy variable for having at least one union in the firm), tenure, industry,10 and occupation.11 The squared terms of age and tenure were also included to capture their nonlinear relationships with wages.

Findings

Table 1 provides the descriptive statistics of the data. The data show that eldercare workers have distinctive characteristics compared with other employees. First, the average hourly wages of eldercare workers are approximately half of those of other employees. Their average formal education level was also lower than that of other occupations. Eldercare workers consisted primarily of older adult women; their average age and share of women were 54 years and 97.3%, respectively. The data also reveal that eldercare workers’ working conditions are more precarious than those of other employees. The share of regular workers and workers in large or public firms is lower than in other occupations, and the proportion of those having at least one union in the firm is far lower than that of other employees.

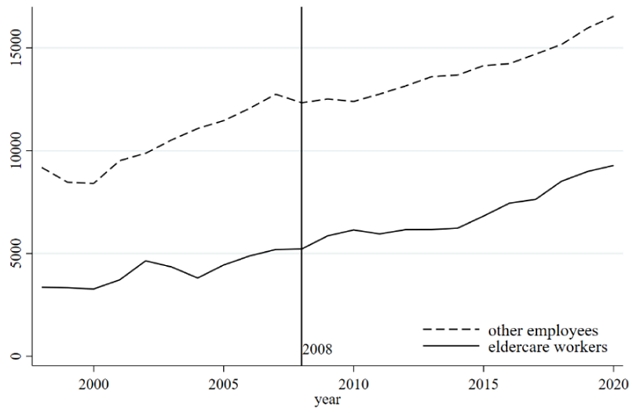

Before conducting the regression analyses, I checked the wage trend in the data based on several figures. Figure 1 plots the average real wages of eldercare workers and other employees over the sample period. The vertical line indicates 2008 data. Wage increase levels were similar in both groups. Because the average wage of eldercare workers was half that of other employees, wage growth rates should have been higher for the eldercare workers.

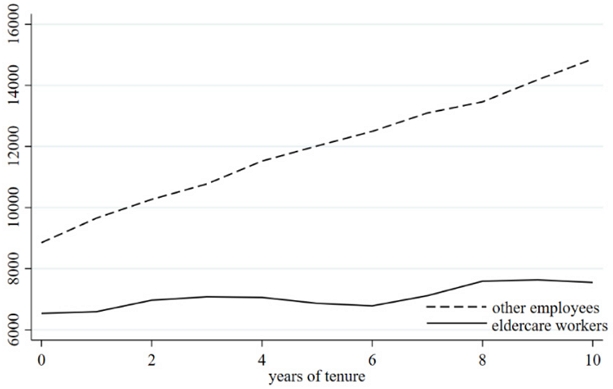

Figure 2 plots the annual growth rates of average wages for eldercare workers and other employees. As anticipated, the wage growth rates are higher for the eldercare workers. More importantly, the difference in wage growth rates between the two groups increased significantly after 2008.

Yearly changes in the ratio of average real hourly wages to those in 1998.The ratio indicates how many times a certain year’s average real hourly wages are higher than the average real hourly wages in 1998.

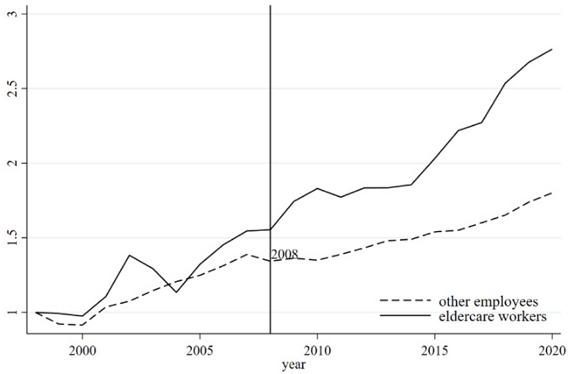

Finally, in Figure 3, I averaged the wages of eldercare workers and other employees over varying years of tenure. Wage increases per tenure are much smaller for the eldercare workers than for other occupations. Although the graphs provide suggestive answers to the questions examined, they are subject to many confounding effects. In the following section, I examine these questions based on regressions.

Table 2 provides the findings on how the introduction of LTC insurance has affected the wage levels of eldercare workers. I began with regressions without fixed effects (Models 1 and 2). Model 1 shows that wages were generally lower for eldercare workers and in the period before 2008. Model 2 includes the interaction between the dummy variables for eldercare workers and the period after 2008. A positive coefficient indicates that the higher wage growth rate after 2008 was more prominent for eldercare workers than for other occupations.

Models 3 and 4 assess whether this effect is robust after including regional, yearly, and individual fixed effects. Model 3 suggests that the wages of eldercare workers are approximately 22.8% lower than those of other employees, net of other characteristics. More importantly, it shows that wage growth after 2008, compared to the period before 2008, was 20.9% higher for eldercare workers than for other employees. Model 4 also includes separate linear time trends for eldercare workers and other employees. Controlling for different time trends, which are higher for eldercare workers, the regression confirms that eldercare workers’ wages increased more significantly than those of other employees after 2008. Overall, the results show that eldercare workers experienced higher wage growth than other occupations after policy introduction.

Table 3 shows the wage returns to tenure for eldercare workers and other employees. I began with a regression analysis without fixed effects or interaction terms. Model 1 shows that wage increases per one more year of tenure are approximately 2.1% and that eldercare workers’ wages are 6.1% lower than those of other employees, other things being equal.

Model 2 includes the interaction between tenure and the dummy variable for eldercare workers, and Model 3 further includes regional, yearly, and individual fixed effects. In Model 3, the wage return for an additional year of tenure is 1.9% for other occupations but 0.8% for eldercare workers. The return to one more year of tenure decreases by 0.025 percentage point per additional year; however, the quadratic term coefficient is ignored for convenience. Interestingly, the negative coefficient of the eldercare worker dummy variable loses significance in Model 3. This change implies that wage penalties for eldercare workers may be due to lower compensation for their job experience.

Finally, Table 4 demonstrates how wage returns to tenure for eldercare workers changed after the introduction of LTC insurance. As before, I gradually saturate the regression with more covariates and fixed effects from Models 1 to 5. From Model 3, I include the triple interaction term of tenure and dummy variables for eldercare workers and the period after 2008. A negative coefficient indicates that wage returns to tenure decreased more significantly for eldercare occupation after 2008. The results remain the same when I include the three types of fixed effects (Models 4 and 5) and the different time trends for eldercare workers and other employees (Model 5). The wage returns to tenure decreased for other occupations from 2.1% per year to 1.4%, ignoring the quadratic term, but the decrease was more significant for eldercare workers (from 2.1% to −2.3%).

The major findings of the regression exercises are as follows. After the introduction of LTC insurance, eldercare workers experienced higher wage increases than other employees. Throughout the sample period, eldercare workers earned lower wages than those in other occupations, controlling for individual employee characteristics, and penalties occurred mainly because of their lower compensation for job experience. Finally, wage returns to tenure for eldercare workers further deteriorated after the introduction of the policy.

Discussion and Conclusion

This study explores how the introduction of LTC insurance has affected the wages of eldercare workers in Korea. To estimate the policy effects on their wages, I analyze 94,457 observations of 12,600 employees from the KLIPS data using a difference-in-differences approach. I find that eldercare workers’ wages increased more than those of other employees after policy introduction. However, the evidence indicates that their wage returns to tenure are lower than those of other employees and that these wage penalties increased after the policy introduction.

These findings partly support Oh and Roh’s (2010) argument that introducing LTC insurance enhanced the conditions of eldercare workers. Given that the eldercare occupation consists predominantly of low-income women workers in Korea, these results are consistent with Mandel’s (2012) finding that lower-income women workers benefit more from welfare-state employment than their higher-income counterparts. This impact of welfare-state employment may be partly attributable to its higher level of workplace regulation and protection from market forces, especially compared to the informal employment of care workers (Gornick & Jacobs, 1998; Yoon, 2011). However, in line with the findings of Gornick and Jacobs (1998) and Mandel and Semyonov (2005), these results challenge the notion that the expansion of the welfare-state guarantees women’s improved status at work.

According to the human capital theory, eldercare workers’ lower wage returns to job experience could be partly due to their lower level of occupational skills (Becker, 1993; England et al., 1988; Kilbourne, England, Farkas, Beron, & Weir, 1994). In the eldercare occupation, the level of skill demands can be lower than in other occupations; therefore, the level of worker productivity cannot be positively related to tenure. It is also possible that eldercare workers are given fewer opportunities for on-the-job training, which is a critical investment in their occupational skills (Becker, 1993).

However, the lower wage returns to work experience in the eldercare occupation could also be partly rooted in the devaluation of their work, in the sense that its major incumbents are women (England et al., 1988; Kilbourne et al., 1994; Levanon, England, & Allison, 2009; Sorensen, 1990). As one of the mechanisms for such earnings disparity, it has been proposed that the work of predominantly female jobs is given a lower value and thereby lower pecuniary rewards because of women’s lower status (Kilbourne et al., 1994; Levanon et al., 2009). England (2005) argues that this perception could have its strongest effect when new jobs are instituted in the economy that are “defined as ‘female’ from [their] beginnings” (Phillips & Taylor, 1980, p. 84), as was the case for LTC workers in Korea.

Additionally, the eldercare workers’ lower wage returns to tenure can be partly explained by care workers’ wage penalties. One possible mechanism for these penalties is the cognitive association of paid care work with care work at home, which is provided mainly by female family members without pay (England, Budig, & Folbre, 2002). According to England et al. (2002), this notion could cause paid care work to be considered a natural activity for women requiring a lower level of skills, even compared to other “female” jobs. Moreover, in Korea, care work by older adult women is valued even less than that of their younger counterparts (Hwang, 2012). These wage penalties may be partly attributable to the social conception of their labor as secondary to their husbands’ or as unskilled because of their shared experiences of career disruption (Kuk & Ko, 2018).

This study has notable limitations, particularly the inability to consider additional factors that may have influenced the wages of eldercare workers. After the introduction of the policy, Korean society experienced the Great Recession and substantial increases in the minimum wage. These shocks can have disproportionately affected eldercare workers with lower socioeconomic status. Another limitation is its research design, which involved comparing eldercare workers with other employees. Although this approach was necessary to maintain an adequate sample size, the heterogeneity between the two groups across various socioeconomic aspects could have influenced the relationship between policy introduction and eldercare workers’ wages.

The current study calls for more research on how defamilialization of care has affected the working conditions of care workers in Korea. In Korea, care workers have mainly been discussed concerning the need to create jobs and ways to improve their service quality (Ham & Kwon, 2017; Heo, 2019; Kuk & Ko, 2018; Oh & Roh, 2010; Peng, 2010; Yoon, 2011). Little attention has been paid to what they have experienced at work under these policies (Heo, 2019; Kuk & Ko, 2018).

The importance of this study lies in its quantitative assessment of the effects of defamilialization of care on the working conditions of care workers. Based on a large representative sample, this study’s findings can stimulate further discussion on the connection between welfare policies and care workers’ working conditions. The welfare state’s impact on care workers’ conditions matters because its role in care employment can be more decisive than that in other sectors (Razavi & Staab, 2010). Given that care workers are generally of lower socioeconomic status and have less “power to voice [their] concerns and to be heard” (Tronto, 2013, p. 108) in policymaking, how the welfare state shapes their conditions requires ongoing attention.

Acknowledgments

This article is part of the author’s unpublished dissertation, titled “Three Essays on the Way Long-term Care Policies Shape Eldercare Workers’ Working Conditions.”

Notes

References

- Becker, G. S. (1993). Human capital: A theoretical and empirical analysis, with special reference to education (3rd ed.). Chicago, IL: The University of Chicago Press.

- Chang, J., Kim, G., Lim, Y., Kang, E., & Kim, M. (2010). The analysis and prospect of care work in the aging society. Seoul, Republic of Korea: Korean Women’s Trade Union. (in Korean).

- Cho, Y. H., Lee, S. W., & Park, J. Y. (2013). The introduction of the public long-term care insurance and the changes in working conditions of care workers: With special attention to wages and employment types. Journal of Korean Social Welfare Administration, 15(2), 193–215. (in Korean).

-

Daly, M., & Lewis, J. (2000). The concept of social care and the analysis of contemporary welfare states. The British Journal of Sociology, 51(2), 281–298.

[https://doi.org/10.1111/j.1468-4446.2000.00281.x]

-

England, P. (2005). Emerging theories of care work. Annual Review of Sociology, 31, 381–399.

[https://doi.org/10.1146/annurev.soc.31.041304.122317]

-

England, P., Farkas, G., Kilbourne, B. S., & Dou, T. (1988). Explaining occupational sex segregation and wages: Findings from a model with fixed effects. American Sociological Review, 53(4), 544–558.

[https://doi.org/10.2307/2095848]

-

England, P., Budig, M., & Folbre, N. (2002). Wages of virtue: The relative pay of care work. Social Problems, 49(4), 455–473.

[https://doi.org/10.1525/sp.2002.49.4.455]

- Esping-Andersen, G. (1990). The three worlds of welfare capitalism. Cambridge, UK: Polity.

-

Estévez-Abe, M., & Naldini, M. (2016). Politics of defamilialization: A comparison of Italy, Japan, Korea and Spain. Journal of European Social Policy, 26(4), 327–343.

[https://doi.org/10.1177/0958928716657276]

- Gornick, J. C., & Jacobs, J. A. (1998). Gender, the welfare state, and public employment: A comparative study of seven industrialized countries. American Sociological Review, 63(5), 688–710.

-

Hagen, K. (1991). Welfare state employees: Where did they come from? International Journal of Sociology, 21(1), 59–90.

[https://doi.org/10.1080/15579336.1991.11770008]

- Ham, S., & Kwon, H. (2017). Care penalty: Devaluation and marketization of care. Korean Journal of Labor Studies, 23(3), 131–176. (in Korean).

- Heo, E. (2019). Trilemma of social service policy-making and the low-wage jobs of long-term care for elderly. Korean Journal of Labor Studies, 25(3), 195–238. (in Korean).

-

Huber, E., & Stephens, J. D. (2000). Partisan governance, women’s employment, and the social democratic service state. American Sociological Review, 65(3), 323–342.

[https://doi.org/10.2307/2657460]

- Hwang, D. (2012). The characteristics and labor market structure of care work in Korea. In D. Hwang (Ed.), The analysis of social service labor market: Focusing on care services (pp. 11–39). Seoul, Republic of Korea: Korea Labor Institute. (in Korean).

- Kang, E., Lee, Y., Lim, J., Choo, B., & Bae, H. (2019). The 2019 survey on long-term care services. Sejong, Republic of Korea: Ministry of Health and Welfare. (in Korean).

-

Kilbourne, B. S., England, P., Farkas, G., Beron, K., & Weir, D. (1994). Returns to skill, compensating differentials, and gender bias: Effects of occupational characteristics on the wages of white women and men. American Journal of Sociology, 100(3), 689–719.

[https://doi.org/10.1086/230578]

-

Kolberg, J. E. (1991). The gender dimension of the welfare state. International Journal of Sociology, 21(2), 119–148.

[https://doi.org/10.1080/15579336.1991.11770010]

- Kuk, M., & Ko, H. S. (2018). A study to enhance working environment for social service worker in Seoul: Mainly around in-home long-term care worker. Seoul, Republic of Korea: Seoul Foundation of Women and Family. (in Korean).

- Lee, B. (2010). Conclusion. In K. Shin & B. Lee (Eds.), A sociological study of wage determination in Korea I (pp. 349–358). Paju, Republic of Korea: Hanul Academy. (in Korean).

-

Levanon, A., England, P., & Allison, P. (2009). Occupational feminization and pay: Assessing causal dynamics using 1950–2000 U.S. Census Data. Social Forces, 88(2), 865–891.

[https://doi.org/10.1353/sof.0.0264]

-

Mandel, H. (2012). Winners and losers: The consequences of welfare state policies for gender wage inequality. European Sociological Review, 28(2), 241–262.

[https://doi.org/10.1093/esr/jcq061]

-

Mandel, H., & Semyonov, M. (2005). Family policies, wage structures, and gender gaps: Sources of earnings inequality in 20 countries. American Sociological Review, 70(6), 949–967.

[https://doi.org/10.1177/000312240507000604]

- Ministry of Health and Welfare. (2019). Microdata from the 2019 survey on long-term care services. Statistics Korea. (in Korean). Retrieved April 16, 2024, from https://mdis.kostat.go.kr/index.do

-

Morgan, K. J. (2005). The ‘production’ of child care: How labor markets shape social policy and vice versa. Social Politics, 12(2), 243–263.

[https://doi.org/10.1093/sp/jxi013]

- Nam, W. (2021). The 2021 survey on long-term care service workers in Seoul. The Eldercare Workers’ Support Center in Seoul. (in Korean). Retrieved April 16, 2024, from http://dolbom.org/sub/sub06_01.php?boardid=data1&mode=view&idx=43&sk=&sw=&offset=10&category=

- National Health Insurance Service. (2023). 2022 long term care insurance statistical yearbook. Wonju, Republic of Korea: National Health Insurance Service. (in Korean).

- National Human Rights Commission of Korea. (2012). Press release: NHRCK recommends policy changes for the labor human rights of long-term care workers. Seoul, Republic of Korea: National Human Rights Commission of Korea. (in Korean).

- National Human Rights Commission of Korea. (2022). Press release: NHRCK recommends policy changes to enhance eldercare workers’ conditions and public eldercare provision. Seoul, Republic of Korea: National Human Rights Commission of Korea. (in Korean).

-

OECD. (2020). Who cares? Attracting and retaining care workers for the elderly, OECD health policy studies. Paris, France: OECD Publishing.

[https://doi.org/10.1787/92c0ef68-en]

- Oh, E., & Roh, E. (2010). Impact of institutionalization of care services on the woman’s workforce: Focused on the comparison between carehelpers for the elderly and caregivers for the sick. The Journal of Asian Women, 49(2), 185–215. (in Korean).

-

Orloff, A. S. (1993). Gender and the social rights of citizenship: The comparative analysis of gender relations and welfare states. American Sociological Review, 58(3), 303–328.

[https://doi.org/10.2307/2095903]

-

Orloff, A. (1996). Gender in the welfare state. Annual Review of Sociology, 22, 51–78.

[https://doi.org/10.1146/annurev.soc.22.1.51]

-

Peng, I. (2010). The expansion of social care and reform: Implications for care workers in the Republic of Korea. International Labour Review, 149(4), 461–476.

[https://doi.org/10.1111/j.1564-913X.2010.00098.x]

-

Phillips, A., & Taylor, B. (1980). Sex and skill: Notes towards a feminist economics. Feminist Review, 6(1), 79–88.

[https://doi.org/10.1057/fr.1980.20]

-

Razavi, S., & Staab, S. (2010). Underpaid and overworked: A cross-national perspective on care workers. International Labour Review, 149(4), 407–422.

[https://doi.org/10.1111/j.1564-913X.2010.00095.x]

- Seok, J. (2010). The improvement of long-term care insurance from the perspective of service providers. Health and Welfare Policy Forum, 168, 34–44. (in Korean).

- Shin, K., Nam, W., Jang, B., Ryu, I., Choi, J., Lim, J., Yoon, J., Choi, K., & Yoon, M. (2013). Working conditions and improvement plan for care helpers in Seoul. Seoul, Republic of Korea: The Seoul Institute. (in Korean).

-

Sorensen, E. (1990). The crowding hypothesis and comparable worth. The Journal of Human Resources, 25(1), 55–89.

[https://doi.org/10.2307/145727]

- Statistics Korea. (2000a). Korean Standard Classification of Occupations Revision 5. Korean Statistical Classification. (in Korean). Retrieved April 16, 2024, from https://kssc.kostat.go.kr:8443/ksscNew_web/index.jsp#

- Statistics Korea. (2000b). Korean Standard Industrial Classification Revision 8. Korean Statistical Classification. (in Korean). Retrieved April 16, 2024, from https://kssc.kostat.go.kr:8443/ksscNew_web/kssc/main/main.do?gubun=1#

- Tronto, J. C. (2013). Caring democracy: Markets, equality, and justice. New York, NY: New York University Press.

- Yoon, J. (2011). Introduction. In J. Yoon (Ed.), A study of the working conditions in the care service sector in Korea I (pp. 1–9). Seoul, Republic of Korea: Korea Labor Institute. (in Korean).

Biographical Note: Eunjung Lee is a PhD student in the Department of Sociology at Yonsei University, South Korea. Her research interests center on gender and labor. E-mail: ejlee738@gmail.com