Beyond Gender Stereotypes: An In-Depth Exploration of the Job Performance of Women in Bangladesh’s Banking Sector

Abstract

Bangladesh has made significant strides in promoting gender equality and women empowerment. Female bankers in Bangladesh consistently demonstrate exceptional competence and professionalism, disproving the notion that men dominate the banking industry. This study examined the intricacies of gender dynamics within the Bangladeshi banking sector, focusing specifically on women’s job performance. A quantitative approach was employed. A total of 248 female bankers participated in the cross-sectional survey. The findings revealed that a suitable working environment, gender stereotypes, training facilities, superior–subordinate relationships, and excessive workload affected their job performance. This study also investigated the job performance of women at various hierarchical levels within banking organizations in Bangladesh. It was found that women bankers face obstacles to their professional advancement owing to gender stereotypes, workplace bullying, managing work–life balance, and societal stereotypes, despite the presence of a comfortable working environment, training facilities, and promotion opportunities. Therefore, researchers argue that by addressing these issues, the banking sector in Bangladesh could establish an ideal atmosphere for the professional development of women bankers.

Keywords:

Job performance, banking industry, women bankers, gender stereotypes, job satisfactionIntroduction

Classified as a developing nation, Bangladesh has already attained the status of having the most rapidly expanding economy (Ahmed & Akter, 2022). The banking industry in Bangladesh is crucial for the country’s economic progress (Khuda, 2019). As the financial backbone of a nation, banks facilitate capital mobilization, investment, and credit allocation, fostering entrepreneurship and industrial growth (Qamruzzaman & Jianguo, 2017). Because there is a strong correlation between economic growth and the expansion of the banking industry, it plays a crucial role in promoting sustainable economic development (Ahmed, Hasan, & Akter, 2023) and reducing poverty by providing assistance for infrastructure projects, small firms, and agribusinesses (Sarker, Ghosh, & Palit, 2015). There are many categories within the banking sector in Bangladesh (Ahamed, 2014), such as government-owned development finance institutions and nationalized, private, and foreign commercial banks (Siddikee, Parvin, & Hossain, 2013).

Bangladesh has 61 scheduled banks (6 state-owned commercial, 3 specialized, 43 private commercial, and 10 foreign commercial banks) that operate under the complete administration and supervision of the Bangladesh Bank (Bangladesh Economic Review, 2022). This authority was granted to the Bangladesh Bank under the Bangladesh Bank Order of 1972 and the Bank Company Act of 1991 (Ministry of Law, 2003). Conversely, five non-scheduled banks in Bangladesh provide financial services to their stakeholders and customers (Bangladesh Bank, 2023).

However, current data from the Bangladesh Bank indicate that, as of June 2022, the total number of employees in banks was 193,742, with 31,548 female employees. In addition, statistics revealed that the female workforce’s involvement in the employment market had previously seen a significant increase, but this development has recently slowed, suggesting that the banking sector of the nation has also been affected by this reduced growth (Uddin, 2022). Slower growth was also observed in the national banking sector. The statistics further revealed that the situation remains the same for entry-level banking positions, where women comprise just 16.86% of the workforce; in June 2019, this proportion was 15.48% (Uddin, 2022).

In this context, Bidisha, a professor of economics, said that while the nation has achieved significant economic progress in recent years, the proportion of women participating in the labor market has not kept pace with the current trends (Hossain, 2024). This argument was validated by recent statistics from the Bangladesh Bank, showing that the percentage of women in the workforce is now at 17.04% at the entry level and at 15.79% and 9.36% at the mid- and higher-entry levels, respectively. These statistics indicate that the growth of the female workforce in entry-, mid-, and high-level positions was extremely low. In addition, the representation of women in banking organizations has marginally decreased, with their percentage decreasing from 14.22% in 2022 to 13.51% in 2023. In 2023, the attrition rate of women in bank employment will have risen to more than 16%, marking a 1% increase compared with the previous year (Staff Correspondent, 2024). Despite the presence of women in various hierarchical positions in Bangladesh, their representation has remained disproportionately low. The data from IDLC Finance Ltd. revealed that a mere 6% of women occupy top management positions, while 14% of women are employed in middle management roles and 18% work in entry-level jobs. Unfortunately, private commercial banks have no female chief executive officers or managing directors in private commercial banks (Rashid, 2018).

Similarly, women face more challenges in maintaining employment than men because of the additional duties associated with managing domestic tasks. Despite constituting approximately 36% of the entire workforce in the country’s employment sector, female involvement in the country’s overall labor market has stagnated in recent years (Uddin, 2022).

Despite the increasing number of women in banking roles, questions remain about whether gender-based biases, cultural norms, or organizational structures affect the job performance evaluations of women compared with their male counterparts (Tabassum & Nayak, 2021). Therefore, this study seeks to unravel these complexities by offering an in-depth analysis of the experiences, challenges, and successes of women professionals in the Bangladeshi banking sector. Specifically, the study uses a quantitative methodology to comprehensively examine the job performance of women in both the public and private commercial banking sectors in Bangladesh. In this vein, the job performance of women in the banking industry is contingent on several variables, including the working environment, workplace bullying, excessive workload, superior–subordinate relationships, job satisfaction, gender stereotypes, gender discrimination, training facilities, promotion facilities, individual aptitude, credentials, tenure, and the prevailing organizational ethos.

Moreover, the insufficient allocation of resources for women’s career development has become a significant obstacle in enhancing female involvement in banking careers. Women also face different challenges than men do in maintaining their careers because of family obligations. The main reason behind this argument is that women play a crucial role in household tasks, caregiving for children and elderly members, and providing emotional support to family members, which pose significant obstacles to effectively carrying out their professional duties. In addition, the absence of certain infrastructure amenities, such as inadequate transportation and training centers for skill enhancement, are recognized as contributing factors that affect the work performance of women in the Bangladeshi banking sector (Saif, Uddin, Haque, Rahman, & Al Mamoun,2016). However, it is crucial to acknowledge that women in Bangladesh have made substantial progress in the banking sector in recent years and actively contributed to the industry’s growth and development (WFID, 2022). Therefore, this detailed analysis aims to provide significant insights beyond gender stereotypes to promote more nuanced knowledge of the variables that influence the employment performance of women in Bangladesh’s banking industry.

Aim and Objectives

The principal aim of this study was to conduct an in-depth exploration of the job performance of women in the Bangladeshi banking sector, moving beyond gender stereotypes to identify the multifaceted factors influencing their professional success and challenges. This study intended to identify the main factors influencing the job performance of women in public and private commercial banks in Bangladesh, with a focus on equal treatment of women.

The specific objectives were as follows:

- a) To identify the factors that influence the job performance of women in Bangladesh’s banking sector.

- b) To evaluate the job performance of women at various hierarchical levels within banking organizations in Bangladesh.

Literature Review

Bangladesh’s banking industry is a critical arena for exploring women’s job performance because of its strategic importance in the country’s economic landscape. Despite the increasing number of women in banking roles (e.g., junior officers, provisionary officers, officers, senior officers, principal officers, and senior principal officers), questions arise about whether gender stereotypes, the working environment, workplace bullying, work–life balance, work stress, and the organizational hierarchy affect the job performance of women compared with their male counterparts. Women’s job performance in banking organizations indicates high levels of professionalism, dedication, and competence. Women in these institutions frequently demonstrate exceptional performance in a variety of capacities, including in financial management, customer service, and leadership roles, thereby substantially contributing to the organization’s performance and goals. Women frequently exhibit a strong commitment to regulatory stan dards and effective customer relationship management in public commercial banks and versatility in adapting to competitive market demands and innovation in financial services in private commercial banks (Orbih & Imhonopi, 2019). Therefore, this study unravels these complexities through an in-depth analysis of female professionals’ experiences, challenges, and successes in the Bangladeshi banking sector. Conceptual definitions can help clarify the circumstances of this study.

Thomas (2022) articulated that work–life balance refers to the ability to effectively handle personal matters during working hours without requiring permission or justification from others. Another often-used definition of work–life balance is the equitable allocation of time and importance to both personal and professional endeavors (Thomas, 2022). Kenton (2022) argued that organizational structure is a systematic framework that delineates the direction of specific operations to accomplish an organization’s objectives. These activities may include regulation, function, and obligations (Kenton, 2022). Correspondingly, any work arrangement that provides employees with greater flexibility in their work style is referred to as flexible work. Such work can be location-based, such as working from home, or time-based. Flexible working policies help employees obtain more control over their work schedules and coordinate their professional and personal lives (Sands, 2022). Following this perspective, Motowidlo (2003) asserted that job performance refers to the total estimated worth of the organization of all distinct behavioral episodes that a person engages in over a certain period of time. It demonstrates the behavioral traits and episodic and collective efforts of employees within organizations (Motowidlo, 2003). Accordingly, job satisfaction pertains to employees’ broad views of their duties. This determines their state of satisfaction and well-being regarding their accomplishments in their work positions and environment, which can affect job performance, absenteeism, and attrition (Dagli, 2023). From this perspective, related literature has been discussed in the following sections.

Rahman and Khan (2020) investigated the impact of women’s status on career progression in Bangladesh’s banking industry. They specifically examined the current situation and influence of promotions on the position of women in the banking sector in Bangladesh using a quantitative research technique and a purposive sampling strategy. The study revealed that female employees constituted 16.7% of the workforce in state-owned commercials, 13.5% in private commercials, and 13.08% in specialized banks; only 25% of female employees held entry-level positions. The study also exhibited a significant correlation between women’s status and their frequency of promotions (Rahman & Khan, 2020). However, the study overlooked the job performance of women in Bangladesh’s banking sector beyond gender stereotypes. Rahman (2019) quantitatively examined the job satisfaction of women bankers in Bangladesh based on their nature of work, workplace support, work–life balance programs, mental well-being, salary, and monetary benefit indicators. He primarily focused on the socioeconomic and demographic characteristics of Bangladesh to depict the nature of women’s employment in the country’s banking sector (Rahman, 2019).

Uddin and Kabir (2016) examined the employment satisfaction of male and female executive bankers in Bangladesh by focusing on the contribution of women to the nation’s economic development and emphasizing the advancing involvement of women in Bangladesh’s banking sector. The findings revealed the job satisfaction of male and female bankers by evaluating many aspects of their work such as compensation, advancement opportunities, managerial oversight, nature of the work, and colleagues. The results specifically indicated that female employees express greater happiness in three of the five aspects of their employment, whereas male employees exhibit dominance in the other two categories (Uddin & Kabir, 2016). However, this study did not elucidate women’s job performance in the banking sector. Correspondingly, the research conducted by Saif et al. (2016) examined the variables that influence the job satisfaction of women employees in private commercial banks in Bangladesh. The research demonstrated that work satisfaction is profoundly influenced by several factors, such as organizational behavior, human resource management, and organizational management. The research adopted a quantitative methodology and a descriptive analysis. The findings indicated that various factors, such as job security, involvement in decision-making, access to leave benefits, attitude of the top management, salary increases, dedicated family time, promotion opportunities, and flexible working hours significantly influence the job satisfaction of female employees in private commercial banks in Bangladesh (Saif et al., 2016). Nevertheless, this study focused only on the work satisfaction of female bankers employed in private commercial banks and failed to portray their job performance in both private and public banks in Bangladesh.

Correspondingly, Uddin, Ali, and Khan (2020) examined the effects of workplace support, supervisory support, and work–life balance rules on the work–life balance of female bankers in Bangladesh. A questionnaire survey was administered to gather data from 558 female employees in commercial banks. Workplace assistance, supervisory support, and work–life balance regulations had a substantial impact on achieving improved work–life balance among female bankers. Moreover, the findings have significant implications for researchers, professionals, policymakers, practitioners, regulators, and female bankers. The study offered valuable insights into the elements that might help achieve a more favorable work–life balance for female employees in the banking industry (Uddin, Ali, & Khan 2020).

From a South Asian perspective, Kodagoda (2019) examined how managerial women manage stress related to their work and family responsibilities using secondary data. The study initially emphasized that women have made significant progress in their education and are increasingly entering the labor force. Its findings revealed that working women’s mothering and work responsibilities are significant predictors of work–family stress. The study also suggested that the contemporary world’s top priority is balancing the demands of employment and motherhood (Kodagoda, 2010). Similarly, Kodagoda (2019) conducted another study on gendered norms and HRM practices in the Sri Lankan public banking sector. The findings revealed that female bankers have sound skills and a strong desire to work in top managerial positions in the public banking sector. However, the state bureaucracy implicitly restricts women’s aspirations to advance to managerial positions and decision-making roles. In this regard, the research recommended that banking organizations establish and sustain improved human resource practices and organizational cultures to promote organizational effectiveness and gender equality (Kodagoda, 2019).

While previous studies have examined the career development and job satisfaction of women in the banking industries in Bangladesh and South Asia, there has not yet been a comprehensive study to explore the factors that influence the job performance of female bankers in Bangladesh. Moreover, no previous studies have specifically examined the various aspects influencing women’s professional performance in relation to the difficulties of gender stereotypes. Previous research differs significantly from the proposed study in terms of study area, sampling techniques, research methodology, variables, and data collection procedures. Therefore, it is important to conduct further studies on this topic.

Theoretical Framework

The standpoint theory is a feminist sociological approach that suggests that people’s perceptions are influenced by their social positions and experiences, resulting in distinctive insights into their disadvantaged or oppressed status (McLaughlin, 2003). The present study utilized the concept of the standpoint theory to comprehend how the distinct social positions and experiences of women (Ruck, Rutherford, Brunner, & Hametner, 2019) have an impact on their job performance. According to this theoretical framework, individuals who are disregarded in society, such as women working in industries dominated by men, possess a unique and valuable perspective that provides a crucial analysis of power dynamics, social structures, and organizational culture. This theory also examined how the experiences of women, as a devalued group in Bangladesh’s banking industry, influence their perceptions of workplace dynamics and job performance. Drawing on this theoretical framework, the current study examined the impact of different factors (working environment, gender stereotypes, gender biases, workplace bullying, job satisfaction, excessive workload, and work–life balance) on the job performance of female bankers in Bangladesh. Accordingly, a survey questionnaire was formulated to encompass the subjective viewpoints and experiences of female employees within the banking industry in Bangladesh. The standpoint theory had a substantial impact on this research by illuminating the intricate mechanisms through which gendered expectations and stereotypes influence women’s job performance.

Although this study is rooted in the standpoint theory, critics contend that the theory has a propensity to disproportionately simplify and homogenize the experiences of women, disregarding individual variations such as socioeconomic status, race, and personal situations. The critics further articulate that without considering these variations, the application of the standpoint theory in the banking sector may result in inadequate or distorted interpretations of women’s job performance, which can neglect the diverse factors that influence their professional lives (Cabrera, Belloso, & Prieto, 2020). Despite several criticisms of the standpoint theory, researchers have argued that it plays a crucial role in investigating the different factors (working environment, gender stereotypes, gender biases, workplace bullying, and excessive workload) that impact women’s job performance in the Bangladeshi banking sector. Moreover, the theory enhances the overall understanding of women’s challenges and prospects in professional spheres.

Method

This study used a quantitative cross-sectional survey approach, which allowed for the gathering of detailed data from a large sample at a particular time, making it easier to examine the numerous variables affecting job performance among women bankers in Bangladesh. This method enabled a descriptive analysis of participants’ experiences and present situations, providing insights into the frequency of and relationships among different variables. Through a descriptive data analysis, the researchers were able to identify relationships, trends, and patterns that shed light on the ways in which working environments, organizational policies, and individual characteristics affect women’s job performance. The target population consisted of female bankers who worked in various roles, including junior, provisional, senior, principal, and senior principal officers, in public and private commercial banks in Bangladesh. The authors focused on both the public and private commercial banking sectors as the study’s main objective was to investigate the work performance of women bankers throughout the country. However, this study did not compare the performance of female bankers in public and private commercial banks.

According to the z-score, the calculated sample size was 270, with a 90% confidence level and a 5% margin of error, from a total population of 31,548 individuals. This sample size guaranteed that the estimates from the sample will be within 5% of the true population proportion 90% of the time. Because of the lack of female bankers who worked in junior and mid-level management under two divisions—the Dhaka and Mymensingh divisions—in Bangladesh, the researchers took data from 248 female bankers based on stratified random sampling. Therefore, 248 female bankers participated in a cross-sectional survey of both public and private commercial banking organizations. Although the study sample was a small proportion of the total population of 31,548 female employees in the banking sector in Bangladesh, various methodological and statistical factors support the generalization of the findings to the larger population. In particular, this study used stratified random sampling to ensure representation from different hierarchical and departmental levels and to enhance the probability of obtaining a sample that properly represents the variety of individuals within the community.

As women are mostly absent from the top management of the banking sector (in both public and private banks) in Bangladesh, women bankers from different hierarchies, including junior and mid-level management, participated in the survey (Table 1). The survey questionnaire was designed in line with the principles of the standpoint theory to capture the subjective perspectives and experiences of female employees in the banking industry. The subjective perspectives primarily focused on a suitable working environment, career advancement, gender stereotype effects, training facilities, superior–subordinate relationships, promotion opportunities, job satisfaction, and work–life balance.

The data collection process employed a combination of physical and electronic means to ensure comprehensive coverage and accessibility. Physical surveys were administered and collected face-to-face with target individuals who might have had restricted access to digital platforms, whereas electronic surveys were distributed through email and online survey tools to enable participation from those who were more comfortable with digital communication. This mixed-method approach to data collection not only increased response rates, but also facilitated the selection of a diverse and representative sample, thereby improving the reliability and depth of the study’s findings on the job performance of women in the banking sector, which transcended traditional gender stereotypes.

The survey included closed-ended questions and a 5-point Likert scale to quantify participants’ perceptions and experiences regarding the organizational culture, working environment, mentorship, professional development opportunities, and gender-specific challenges. Closed-ended questions simplified the collection of explicit, quantifiable data by offering predefined response options, which expedited the analysis and ensured consistency in responses. The 5-point Likert scale, which ranges from Strongly disagree to Strongly agree, was employed to evaluate the attitudes, perceptions, and experiences of female bankers concerning their job performance and workforce dynamics. This method allowed the researchers to obtain sensitive insights into how these women perceived their roles and effectiveness, thus enabling an in-depth examination of their performance in the context of prevailing gender stereotypes. The implementation of these structured tools confirmed that the collected data were comprehensive and manageable, thereby establishing a strong basis for developing meaningful conclusions and recommendations.

Quantitative data were analyzed using Microsoft Excel and SPSS. Descriptive statistics, particularly frequency analysis, were used to summarize the participants’ demographic information, and percentage analyses were conducted to demonstrate significant relationships between the independent and dependent variables. This approach provides a clear understanding of the perceptions of the female bankers who participated in the survey. Moreover, the researchers demonstrated the prevalence of specific attitudes toward, behaviors in, and perceptions of job performance by examining the frequency of responses to various survey questions. This approach assisted in identifying anomalies or outliers and emphasized critical areas where gender stereotypes may influence perceptions. A frequency analysis is critical for constructing a comprehensive understanding of the job performance landscape of women in the banking sector. Furthermore, such an analysis can help direct further research and provide strategic suggestions.

The study ensured ethical standards, participant confidentiality, and informed consent. The instrument was tested in a pilot survey to establish its validity and reliability, which enabled researchers to analyze and improve the survey instruments, verifying that the questions were appropriate, transparent, and able to capture the required data. The pilot survey identified operational challenges in data collection and provided insights into the potential response rates. The findings are presented through charts, graphs, and statistical summaries to facilitate clear communication of the quantitative results. These focus on the key trends and significant findings related to the exploration of job performance among female bankers in the public and private commercial banking sectors in Bangladesh.

Results

Based on a cross-sectional survey, this section illustrates the job performance of women in the Bangladeshi banking sector, moving beyond gender stereotypes to identify the multifaceted factors that influence their professional success and challenges. This study presents and analyzes the data using a univariate analysis. Bar, column, and pie charts were used to display the essential facts. A percentage analysis and frequency distribution were used to present the data.

Demographic Information

The demographic segment of the study included data on the respondents’ age, gender, and educational attainment. Demographic information plays a pivotal role in enriching the contextual understanding of research. This study investigated the job performance of women in Bangladesh’s banking sector and explored the factors that influence their job performance.

This study provides a detailed overview of the respondents’ demographic characteristics, offering a full understanding of the female workforce in the banking industry.

The research comprised only female respondents, indicating a concentrated investigation of their experiences and perspectives in Bangladeshi banking organizations. In terms of age distribution, 25% (n = 62) of the participants were in the 25–30 age group, indicating the involvement of young professionals in the research. Most young professionals were junior officers, officers, or trainee officers in public and private commercial banks. A considerable proportion of mid-career professionals, amounting to 57.26% (n = 142), were in the age group of 31–40 years. The respondents in this age category were senior and provisional officers working in public and private commercial banks in Bangladesh. Furthermore, 17.74% (n = 44) of the participants belonged to the 41–60 age group, suggesting the inclusion of seasoned professionals with considerable industry experience, including principal officers and senior principal officers. An analysis of the respondents’ educational backgrounds indicated that 31.05% (n = 77) had undergraduate degrees, whereas a significant majority of 68.95% (n = 171) held postgraduate qualifications. The presence of different educational backgrounds among women highlights their diverse academic credentials, particularly in higher education. Moreover, the survey data revealed that 54.84% (n = 136) of the respondents were unmarried, whereas 45.16% were married. This demographic distribution emphasized a nearly proportional representation of married and unmarried women in the sample population, enabling a thorough examination of the potential impact of marital status on job performance. The substantial number of unmarried respondents indicates that a significant percentage of women in the banking sector manage their careers without the supplementary familial obligations that typically accompany marriage.

This could potentially affect their job performance, work–life balance, and career aspirations in a manner that is distinct from that of their married counterparts. In contrast, the nearly equal representation of married women offers valuable insights into the impact of marital responsibilities, including caregiving and household management.

The survey findings revealed that 53.23% of the respondents had 0–5 years of job experience, 31.04% had 6–10 years of experience, and 15.73% had 11–15 years of experience. The majority representation of women of 53.23% (n = 132) with 0–5 years of job experience indicates that a sizable percentage of women working in the banking industry are still relatively new to their positions. These findings also indicate that relatively less-experienced women bankers may encounter distinctive challenges and opportunities in the context of early career development, such as initial training, acclimatization to the banking environment, and early career progression. Furthermore, 31.04% of the participants (n = 77) comprised those with 6–10 years of work experience, indicating that these women are in their mid-career stages and may face various professional pressures such as striving for higher positions, handling growing responsibilities, and finding a balance between work and personal life. A total of 15.73% of the participants (n = 39) had 11–15 years of professional expertise, indicating that this portion of the workforce often consists of individuals with more experience who may hold senior or management roles. These women were likely to have extensive expertise and experience in banking but encountered difficulties in assuming leadership positions, guiding and supporting junior employees, and maintaining continuous professional development. The survey findings showed that all respondents were full-time employees, indicating a consistent commitment to their professional positions. The demographic information offers a solid basis for analyzing the results of this study, providing useful insights into the viewpoints and experiences of women with different ages, educational backgrounds, marital statuses, years of experience, and types of employment within the banking industry in Bangladesh.

Factors Affecting Women Bankers’ Job Performance in Bangladesh

This study explored the factors affecting the job performance of female bankers in Bangladesh, and this section explains the employment performance of female bankers in Bangladesh.

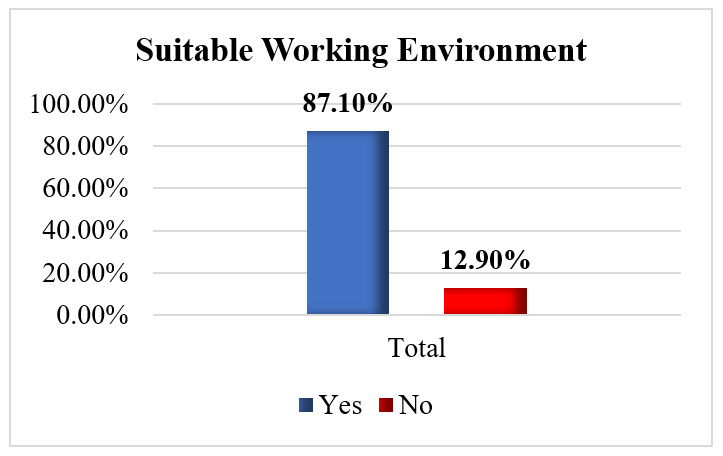

The survey findings indicated that approximately 87.1% (n = 216) of the female bankers perceived their working environment as suitable. This positive response suggests a generally favorable atmosphere for women in Bangladesh’s banking sector. This particularly suggests that female bankers feel welcomed and accepted in their professional roles in banking organizations. Moreover, this percentage indicates that the work environment provides support for female bankers, equal opportunities for professional growth and advancement, and promotes a sense of belonging and teamwork. While a significant majority reported a suitable working environment, it is noteworthy that 12.9% expressed dissatisfaction with their working environment. This information is crucial for implementing targeted improvements and fostering a more inclusive workplace.

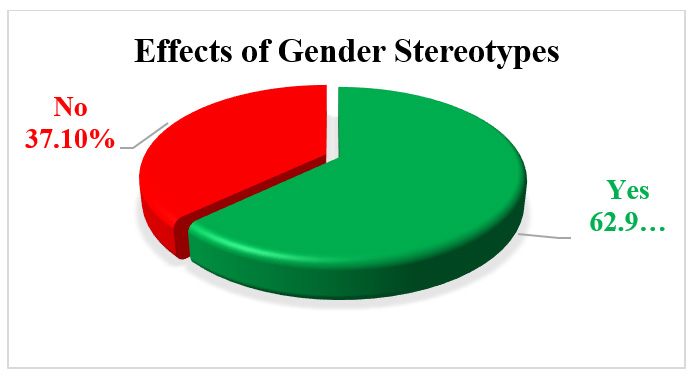

This study also investigated the effects of gender stereotypes on the job performance of women in the Bangladeshi banking sector.

According to the survey, a notable 62.9% (n = 156) of the respondents acknowledged experiencing the effects of gender stereotypes, signaling a concerning prevalence of biased perceptions that could influence professional dynamics. This majority suggests that a significant proportion of women bankers face challenges linked to preconceived notions regarding gender. These effects manifest in various ways, such as limited career opportunities, biased evaluations, and stereotypical expectations, which undermine the confidence and performance of female employees. Conversely, 37.1% (n = 92) of the respondents argued that they did not experience the effects of gender stereotypes, which reflects either a genuine absence of such issues for some women or a potential underreporting for various reasons, including reluctance to disclose personal experiences. However, to address these issues effectively, it is crucial for organizations to initiate targeted interventions, promote awareness, and foster a workplace culture that actively dismantles gender stereotypes, ensuring equal opportunities and fair treatment for all employees.

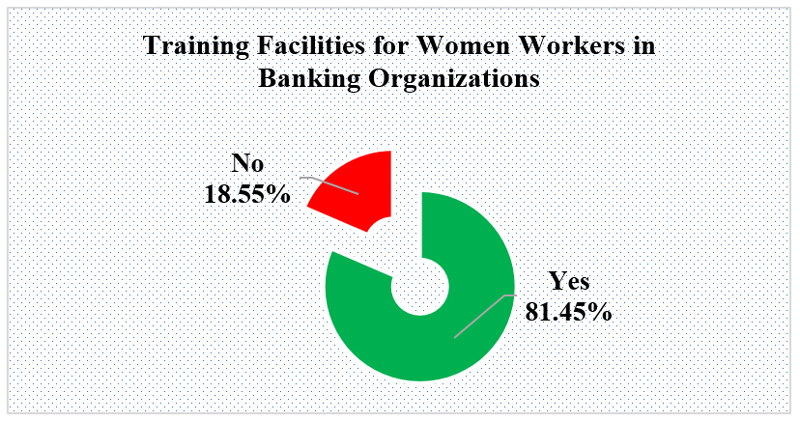

This study also examined training facilities for women employees in the banking industry in Bangladesh.

The field survey illustrates that a substantial 81.45% (n = 202) of the respondents affirmed the presence of training facilities, indicating a positive trend in acknowledging the importance of skill development and professional growth for women in the sector. This suggests that a significant proportion of women working in the Bangladeshi banking industry have access to training programs designed to enhance their knowledge and capabilities. These training initiatives play a crucial role in empowering women, bridging skill gaps, and fostering career advancement. On the other hand, 18.55% (n = 46) of the respondents reported a lack of training facilities in the banking organizations in Bangladesh, which highlights a potential gap in ensuring equal opportunities for skill development.

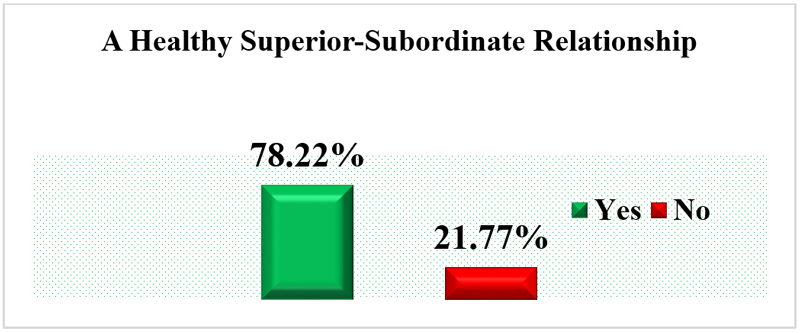

According to the survey, a significant majority, comprising 78.22% (n = 194) of the respondents, reported having healthy relationships with their superiors and subordinates, suggesting that a considerable proportion of women working in the Bangladeshi banking sector perceive a supportive and collaborative atmosphere despite the hierarchical structure. However, 21.77% (n = 54) of the respondents expressed a lack of healthy relationships, signaling a noteworthy concern. Addressing the issues is pivotal to sustaining a workplace culture that values positive relationships and ensures that all employees, irrespective of their gender, feel supported, respected, and empowered in their professional interactions. As organizations seek to enhance diversity and inclusivity, nurturing healthy superior–subordinate relationships has emerged as a key factor in promoting job satisfaction, performance, and overall well-being.

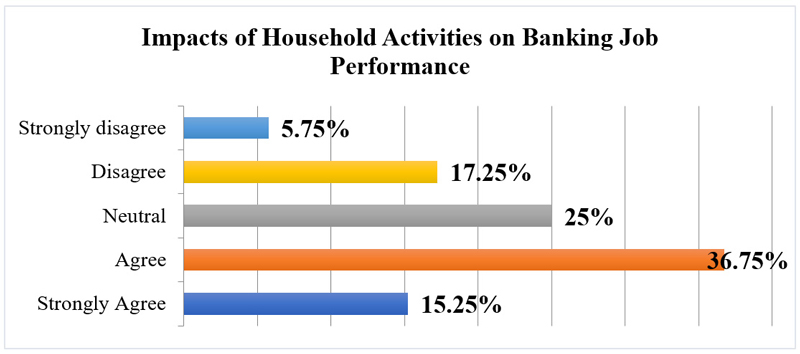

The findings revealed a nuanced spectrum of responses. Approximately 51% (15.25%, i.e., n = 38 strongly agreed and 36.75%, i.e., n = 91 agreed) of the respondents acknowledged that household activities had a notable impact on their job performance. They recognized the intricate balancing act wherein women often navigate between their professional responsibilities in the banking sector and their roles in household activities. The 25% (n = 62) who expressed neutrality might suggest a varied range of experiences, possibly dependent on individual circumstances or organizational support structures. On the other hand, the 22% (17.25%, n = 43 disagreed and 5.75%, i.e., n = 14 strongly disagreed) who perceived a minimal impact of household activities represent a subset of women who feel that their household responsibilities interfere with their job performance in only a limited way. Nevertheless, banking organizations must consider these findings when shaping supportive policies that recognize and accommodate the diverse needs of their female workforce. Strategies such as flexible working hours, family-friendly policies, and targeted support programs may help alleviate the potential negative impact of household activities on the job performance of women bankers, thereby fostering an environment in which employees can thrive both personally and professionally.

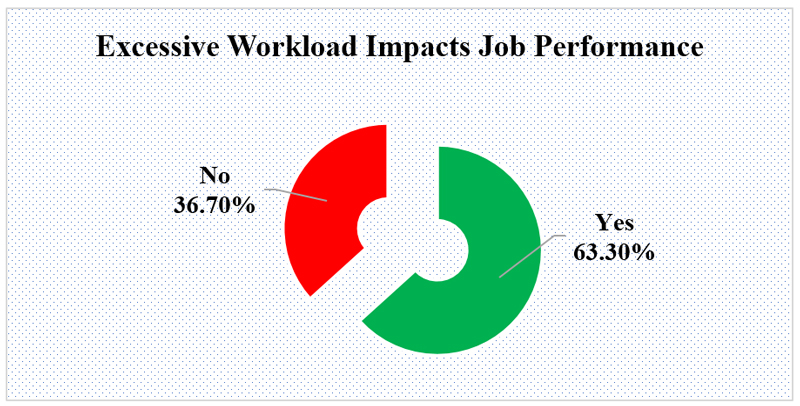

The survey findings underscored a prevalent concern, with a notable 63.3% (n = 157) of the respondents affirming that excessive workload does impede their job performance (Figure 6). This majority response signaled that a substantial proportion of women are grappling with the challenges posed by overwhelming work demands. In contrast, the 36.7% (n = 91) who reported no discernible impact may represent a subset of women who manage their workload effectively, have supportive work environments, or perceive the demands as reasonable. However, recognizing the potential negative effects of excessive workload on job performance is pivotal for banking organizations to craft strategies that promote a balanced and sustainable work environment.

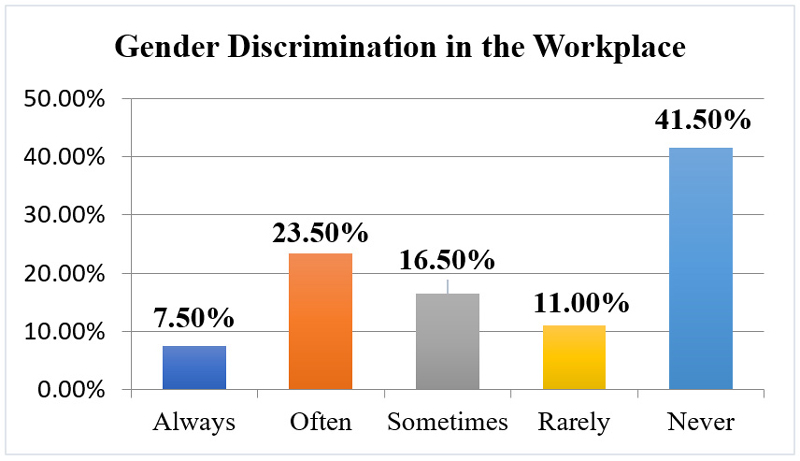

This study also examined the complex issue of gender discrimination in the workplace, revealing a diverse range of perceptions among women in the banking sector. Gender discrimination in the workplace negatively affects women’s job performance.

According to the survey, 7.5% (n = 19) of the respondents reported that they always experienced gender discrimination, indicating an alarmingly consistent pattern of bias (Figure 7). Additionally, 23.5% (n = 58) of the respondents cited that they often experienced discrimination and 16.5% (n = 41) indicated that they sometimes do, which underscores a substantial proportion of women who frequently encounter gender discrimination. These statistics highlight the persistence of discriminatory practices in the banking sector. On a somewhat positive note, a significant 41.5% (n = 103) claimed to have never experienced gender discrimination, thereby signaling a positive perception of a considerable segment. Although a substantial number of respondents reported no personal experience, the acknowledgment of gender discrimination at various frequencies among a significant proportion of women in the study necessitated a thorough examination of the prevailing organizational culture and practices.

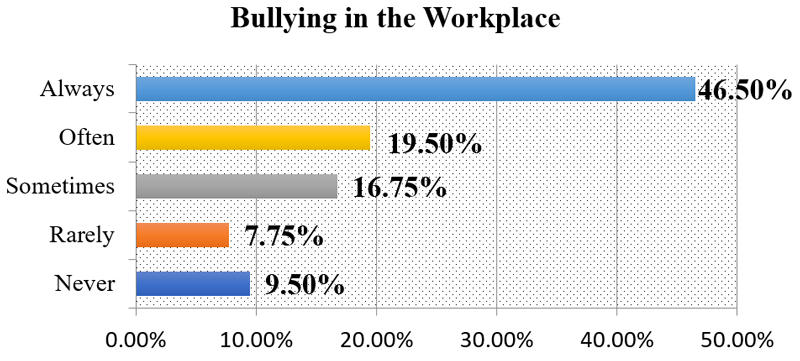

This study revealed the alarming prevalence of workplace bullying among women in the banking industry in Bangladesh and found that workplace bullying adversely affects their job performance.

A staggering 46.5% (n = 115) of the respondents reported always experiencing bullying, indicating a deeply concerning and pervasive issue within the workplace culture. The 19.5% (n = 48) who responded with Often and the 16.75% (n = 42) who mentioned Sometimes underscore the distressing frequency of such negative encounters. These findings suggest that a significant proportion of women in Bangladesh’s banking sector regularly grapple with bullying behaviors. While 9.5% (n = 24) claimed to have never experienced bullying and 7.75% (n = 19) said they had only rarely experienced it, these percentages were non-significant compared with the high incidence of bullying reported by the majority. This highlights a critical challenge demanding urgent attention from organizational leaders and policymakers.

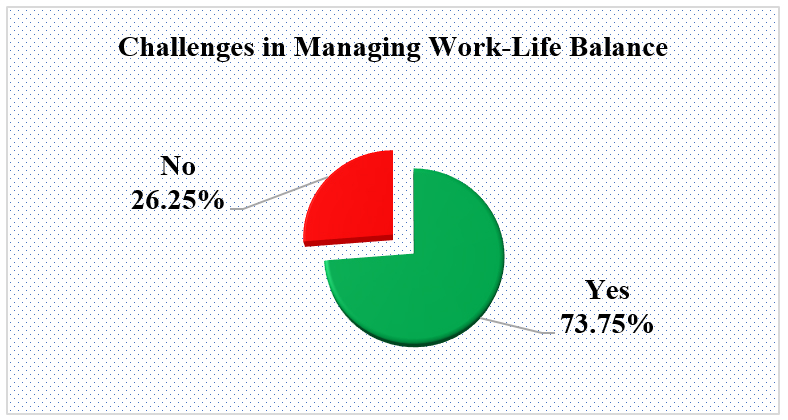

The research revealed that substantial obstacles encountered by women in their endeavors to achieve work–life balance within the banking industry also impact the job performance of female bankers in Bangladesh.

The survey results indicated that a significant majority (73.75%, n = 183) of the participants acknowledged the challenges of achieving a balanced integration of work and personal life. The prevailing reaction highlighted the widespread challenges women face in balancing their responsibilities in the banking industry with their personal obligations. Conversely, 26.25% (n = 65) of individuals who reported no obstacles were in the minority with distinct circumstances or support structures that enabled a smoother blending of work and home life. Nevertheless, the stark majority reporting challenges underscores the pressing need for banking organizations in Bangladesh to reassess policies and practices to better accommodate the work–life balance aspirations of their female workforce.

Job Performance of Women at Various Hierarchical Levels within Banking Organizations in Bangladesh

Table 3 illustrates the management hierarchy and job responsibilities of female bankers in public and private commercial banks in Bangladesh. As the data were collected based on stratified random sampling, the survey revealed that 50% (n = 124) of the respondents worked in public commercial banks and 50% (n = 124) in private commercial banks. They held junior and mid-level management positions at public and private commercial banks.

Approximately 16.13% (n = 40) of the respondents were junior officers and 12.9% (n = 32) were officers at the junior management level in public commercial banks. The percentage of junior officers emphasized women’s experiences and job performance in the early stages of their banking careers. Typically, these women were responsible for entry-level responsibilities and acquiring the essential foundational skills and knowledge to assist in their professional development. Additionally, 12.9% (n = 27) of the respondents were middle management officers who had progressed beyond entry-level positions and taken on additional responsibilities. Examining women’s job performance at this level can provide significant insights into the efficacy of training programs, mentoring, and career development opportunities in public commercial banks.

The survey findings demonstrated that 8.06% (n = 20) of the participants were principal officers and 2.02% (n = 5) were senior principal officers. These individuals were employed in mid-level managerial roles in public commercial banks in Bangladesh. They were responsible for supervising operations, leading teams, and ensuring the successful execution of strategic projects.

The study also demonstrated the management hierarchy and job responsibilities of women bankers in the private commercial banking industry. The findings observed less interest among women bankers in private commercial banks than in public commercial banks in Bangladesh, especially in junior and mid-level management. These findings indicated that women bankers in private commercial banks face more work-related stress than those in public commercial banks. However, they also illustrated that at the junior management level, 14.11% (n = 35) of the respondents were trainees or assistant officers, 10.08% (n = 25) were junior officers, 8.06% (n = 20) were provisionary officers, and 6.05% (n = 15) were officers of private commercial banks. Their duties at various hierarchical levels served as early opportunities for women to enter the private commercial banking industry. Their job performance reflected the effectiveness of the business in assimilating new employees, offering initial training, assisting them in transitioning from routine duties to more challenging responsibilities, and laying the foundation for career advancement. However, by examining the different hierarchical levels within junior management, this study provides a detailed understanding of how job performance varies across the early stages of a woman’s career in a private commercial bank.

Furthermore, the results indicated that 6.05% (n = 15) of the respondents were senior officers, 4.03% (n = 10) were principal officers, and 1.62% (n = 4) were senior principal officers. The common responsibilities of these female banking employees vary based on their position but include team supervision and project management, overseeing multiple departments, implementing strategic initiatives, decision-making authority, extensive managerial responsibilities, and a crucial influence on organizational policies and culture. The job performance of women bankers at this level provides significant insights into how well the organization is equipped with the skills and support needed to manage more complex tasks and the ability to support women in these pivotal roles and lead teams effectively. As this study examined the job performance of female employees in different roles in the banking sector and considered the hierarchical structure typical in these establishments, it aimed to acquire a deeper understanding of prospective disparities and fluctuations in women’s job performance. From this perspective, other factors affecting women bankers’ job performance in Bangladesh are discussed in the following sections.

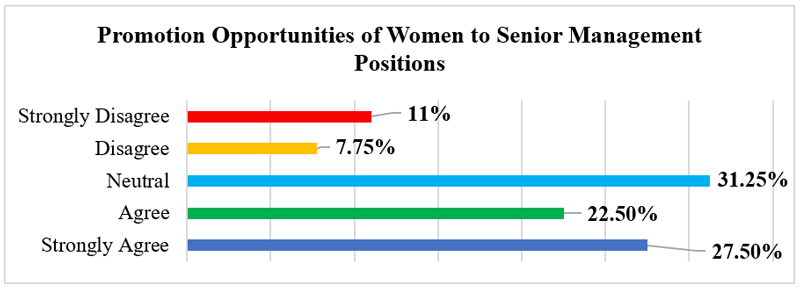

This study explored the perceived promotion opportunities for women, particularly their ascent to senior management positions within the banking sector. The findings offer a nuanced portrayal of opinions, with 50% (27.5%, i.e., n = 68 strongly agreed and 22.5%, i.e., n = 56 agreed) of the participants acknowledging positive promotion prospects. This finding suggests that a substantial proportion of women in the banking sector see avenues for advancement in senior management roles. However, the 31.25% (n = 78) who expressed neutrality on this matter represented a significant segment that neither strongly affirmed nor denied equal promotion opportunities, implying a possible lack of clarity or mixed experiences within the sector. The 18.75% (7.75%, i.e., n = 19 disagreed and 11%, i.e., n = 27 strongly disagreed) who perceived limited promotion opportunities raised concerns about potential barriers hindering the progression of women to senior roles. To promote a gender-inclusive atmosphere and optimize the sector’s diversity of leadership, it is crucial to recognize and address issues affecting women’s opportunities for advancement in Bangladesh’s banking industry.

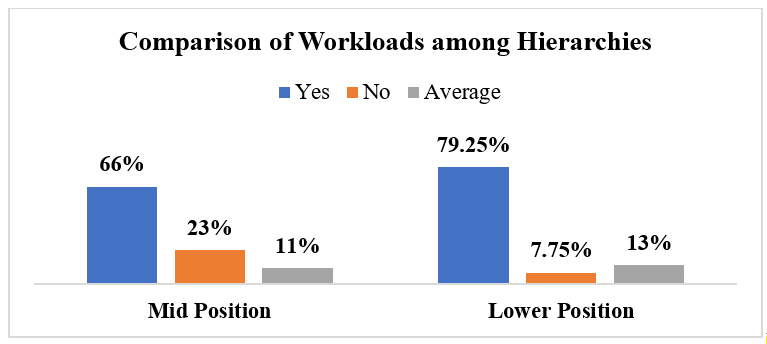

The study scrutinized perceived workloads across hierarchical positions within the banking industry in Bangladesh to emphasize potential disparities.

According to the field survey, in the mid-level position, 66% (n = 164) the respondents affirmed the existence of heavy workloads, portraying a prevalent challenge even in these intermediate roles. Moreover, the 23% (n = 57) who indicated no significant workload impact and the 11% (n = 27) who perceived an average workload in mid-level positions indicate varying experiences among women in these roles.

Notably, in lower positions (junior management level), an overwhelming 79.25% (n = 197) acknowledged heavy workloads, indicating a consistent pattern of significant professional demands across hierarchical levels. The 7.25% (n = 18) who reported no discernible impact and the 13% (n = 32) who perceived an average workload in lower positions underscored the need to explore individual and organizational factors influencing these diverse perspectives. This detailed analysis illuminates the intricate dynamics of workloads within both public and private commercial banks in Bangladesh, indicating that while heavy work demands are a common perception, variations exist in experiences across different hierarchical positions.

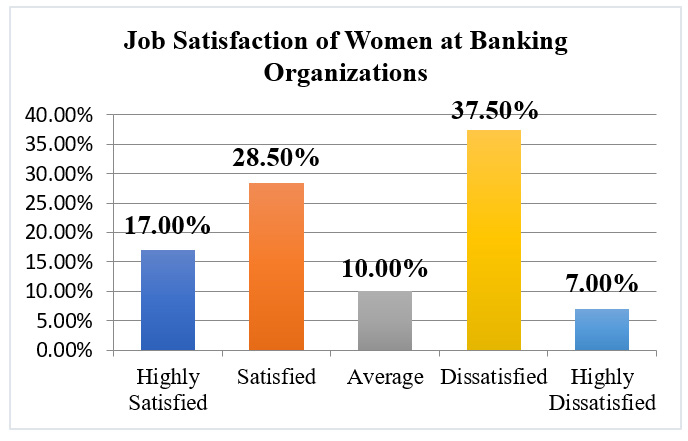

This study also revealed a comprehensive spectrum of job satisfaction among women bankers. The results showed that a notable 17% (n = 42) of the respondents expressed high satisfaction with their jobs, indicative of a content and fulfilled segment within the workforce. Moreover, the 28.5% (n = 71) who reported satisfaction further contributed to a positive narrative, suggesting that a significant proportion of women in the Bangladeshi banking sector find fulfillment in their professional roles.

However, the 10% (n = 25) who indicated an average satisfaction level implied a neutral stance or a balanced mix of positive and negative experiences. The study raises some concerns, with a substantial 37.5% (n = 93) of the respondents expressing dissatisfaction, indicating that a considerable proportion of women face challenges or may be discontented in their roles. This dissatisfaction is rooted in various factors such as workload, growth opportunities, and workplace culture. Additionally, the 7% (n = 17) who reported being highly dissatisfied underscored a subset of women experiencing pronounced dissatisfaction, necessitating a closer examination of the factors contributing to such negative sentiments. As firms want to achieve gender equality and improve workplace contentment, they must understand the complex dynamics of job happiness among women bankers to create pleasant, inspiring, and rewarding professional environments.

Discussion

This study examined the intricate facets of female bankers’ job performance and investigated the limitations imposed by conventional gender biases. In particular, the study explored the factors that influence women’s job performance, their satisfaction levels in various hierarchical positions, and the challenges they face in the banking sector in terms of their job responsibilities. The findings of this study identified several factors, including the working environment, gender stereotypes, and training facilities, healthy relationships between superiors and subordinates, and excessive workload that affect the job performance of female bankers. The results indicated that most female bankers perceive their working environments as suitable, implying that they feel appreciated and acknowledged in their professional positions within the banking sector. Furthermore, the data demonstrated that the work environment offers support to female bankers and equal opportunities for career development and advancement and fosters feelings of inclusion and collaboration. The standpoint theory is important for this research as it evaluates people’s views based on their experiences and social circumstances (McLaughlin, 2003). These findings have been supported by a study that articulated that female employees’ satisfaction in the banking sector is affected by a suitable working environment, salary increments, available opportunities for promotion, and colleague collaboration (Rahman, Gupta, & Moudud-Ul-Huq, 2012). In addition, Udu and Eke (2018) articulated that the physical environment, occupational stress, and distorted responsibility had substantial and varied effects on the performance of female bankers (Udu & Eke, 2018).

The findings further indicated that most respondents encountered gender stereotypes, suggesting a concerning prevalence of biased perceptions that could potentially impact professional relationship dynamics. The presence of this majority indicated that the banking industry in Bangladesh may be experiencing cultural degradation as a substantial number of women in the sector encounter obstacles related to preconceived notions associated with gender. In this context, the findings of a study carried out by Mirza and Jabeen (2011) validated the notion that gender stereotypes impeded the career growth of female employees, particularly those in managerial roles (Mirza & Jabeen, 2011). Moreover, drawing on the standpoint theory, the majority of respondents affirmed that excessive workload impedes their job performance. The findings of the present study align closely with those of a research conducted by Hsu, Bai, Yang, Huang, Lin, and Lin (2019), which revealed substantial correlations of long working hours with both occupational stress and work–life balance. Additionally, Hsu et al. (2019) articulated that long working hours and occupational stress adversely affect the job performance of banking employees (Hsu et al. 2019).

Furthermore, the findings demonstrated that women bankers’ job satisfaction is highly affected by promotion opportunities, work stress levels, and the cooperation of their colleagues. Rahman and Khan (2020), Rahman (2019), and Uddin and Kabir (2016) corroborated these findings. The job satisfaction of female bankers in Bangladesh has been found to be substantially influenced by various factors, as identified by Rahman and Khan (2020) and Rahman (2019), which include the characteristics of the work, support from the workplace, programs promoting work–life balance, mental well-being, salary, and monetary benefits.

In addition, this study investigated several issues, including gender discrimination, workplace bullying, and work–life balance, faced by female bankers in terms of their responsibilities. In this context, Pia, Chowdhury, Kundu, Deb, and Akter (2019) articulated that not only do gender discrimination and work–life balance issues affect job satisfaction but long working hours, pressure from family, and a lack of leave facilities also affect women’s job performance (Pia, Chowdhury, Kundu, Deb, & Akter, 2019). The discussed qualitative insights garnered from secondary data analysis provide a deeper understanding of the sociocultural and organizational dynamics that shape women’s experiences in the banking sector. Therefore, workplace culture is a crucial factor in encouraging diversity and inclusivity in the working environment.

Nevertheless, this study makes both theoretical and practical contributions to the literature. Practically, the findings of this study provide relevant guidelines for the banking sector, that is, policymakers and industry leaders, to address gender disparity issues. These guidelines include fostering an inclusive workplace culture, implementing robust anti-bullying policies, mitigating gender discrimination, and creating employee support networks. Theoretically, this study contributes to a broader understanding of gender dynamics in professional settings and emphasizes the need for context-specific analyses. The study thereby serves as a foundation for future investigations of related sectors and circumstances.

Conclusions

The job performance of women bankers in Bangladesh has exhibited substantial advancement and has depended on several factors, which have had both positive and negative impacts. This study elucidates the job performance of women in the Bangladeshi banking sector and illustrates the multifaceted factors influencing their professional success and challenges. These factors include evolving societal attitudes, government initiatives, women’s personal dedication to excel in their careers, workplace harassment, excessive workload, and the need for work–life balance. However, women bankers have consistently shown remarkable proficiency, professionalism, and commitment, thereby debunking the perception that the banking industry is mostly dominated by males. Moreover, evolving cultural views on gender roles and women’s empowerment have played a crucial role in shaping women bankers’ work performance. Bangladesh has achieved noteworthy progress in advancing gender parity and empowering women, mostly via initiatives targeting women’s education, employment, and access to leadership positions. This has fostered a more inclusive atmosphere and promoted the participation of women in previously male-dominated industries such as banking. Consequently, female bankers have performed exceptionally in their positions, contributing diverse viewpoints, inventive concepts, and strong leadership attributes to the field (Kankaraš, 2024). For example, the central bank of Bangladesh, the Bangladesh Bank, has implemented several strategies to augment women’s involvement in the industry. These include providing training and skill development initiatives, offering financial incentives, and maintaining a favorable work environment. In addition to promoting women’s entry into the banking industry, these initiatives fostered their professional development and progression. Notwithstanding the significant advancements achieved by Bangladesh in women’s employment and empowerment within the banking sector, certain challenges continue to impede their job performance, including work–life imbalance, workplace bullying, excessive workloads, societal stereotypes, and gender discrimination. The following recommendations would provide significant assistance in addressing these issues in Bangladesh’s banking sector.

First, implementing adaptable work arrangements, such as part-time alternatives, job sharing, and telecommuting, to cater to the varied requirements of women employees would be a suitable policy to enhance work–life equilibrium, mitigate stress levels, and enhance overall workplace contentment and productivity. Implementing robust anti-bullying policies, fostering a culture of zero tolerance, and providing effective mechanisms for reporting and addressing such behaviors are essential steps toward eradicating bullying in the workplace.

Second, implementing proactive measures to mitigate gender discrimination, such as awareness programs, diversity training, and transparent grievance mechanisms, will create an environment in which all women feel valued and respected and receive equal opportunities for professional growth.

Third, policies should actively support the advancement of women to senior management positions, break away from gender stereotypes, and implement transparent promotions. These criteria are imperative steps toward achieving a more balanced and equitable professional landscape in the banking sector.

Finally, banks should establish employee support networks for women in the organization, which would provide a platform for women to connect, share experiences, and discuss their issues with others. This study could also serve as a resource for professional development opportunities and advocacy for women bankers in Bangladesh. Through the implementation of these suggestions, the banking industry in Bangladesh can foster an atmosphere conducive to women’s professional growth, productive contributions, and career progression.

References

- Ahamed, M. (2014). A report on banking sector of Bangladesh. Japan Bangla Business Center.

-

Ahmed, T., Hasan, N., & Akter, R. (2023). Journey to smart Bangladesh: Realities and challenges. International Journal of Qualitative Research 3(2), 178–187.

[https://doi.org/10.47540/ IJQR.V3I2.980.]

-

Ahmed, T., & Akter, T. (2022). People’s participation in ensuring good governance at local levels in Bangladesh: A study on union parishads. Journal of Governance and Development, 1(2), 27–46.

[https://doi.org/10.5281/zenodo.8019219]

- Bangladesh Bank. (2023). Bangladesh Bank: Central bank of Bangladesh. Financial System Overview. Retrieved November 29, 2023, from https://www.bb.org.bd/en/index.php/financialactivity/bankfi

- Bangladesh Economic Review. (2023). Monetary management and financial market development. Bangladesh Economic Review, 51–70.

-

Cabrera, M. S., Belloso, M. L., & Prieto, R. R. (2020). The application of feminist standpoint theory in social research. Investigaciones Feministas, 11(2), 307–318.

[https://doi.org/10.5209/infe.66034.]

- Dagli, K. (2023). What is job satisfaction? Meaning, importance and examples. Together Mentoring Software. Retrieved June 12, 2024, from https://www.spiceworks.com/hr/engagement-retention/articles/what-is-job-satisfaction, /

- Hossain, S. (2024). Steps needed to bring women in Bangladesh into workforce. New Age. Retrieved March 25, 2024, from https://www.newagebd.net/post/ Interview/232151/steps-needed-to-bring-women-in-bangladesh-into-workforce

-

Hsu, Y. Y., Bai, C. H., Yang, C. M., Huang, Y. C., Lin, T. T., & Lin, C. H. (2019). Long hours’ effects on work–life balance and satisfaction. BioMed Research International, 2019(1), 1-8.

[https://doi.org/10.1155/2019/5046934.]

- Kankaraš, M. (2024). Nurturing women in leadership: Why development matters. Leadership Trust Training & Development Limited. Retrieved June 12, 2024, from https://www.leadershiptrust.co/insights/nurturing-women-in-leadership, /

- Kenton, W. (2022). Organizational structure for companies with examples and benefits. Investopedia, 1–9. Retrieved June 12, 2024, from https://www.investopedia. com/terms/o/organizational-structure.asp

- Khuda, B. (2019). Economic growth in Bangladesh and the role of banking sector. The Financial Express, June 12, 7. Retrieved January 12, 2019, from https://thefinancialexpress.com.bd/views/views/economic-growth-in-bangladesh -and-the-role-of-banking-sector-1547220114

-

Kodagoda, T. (2010). Work–family stress of women managers: Experience from banking sector in Sri Lanka. International Journal of Management and Enterprise Development, 9(2), 201–211.

[https://doi.org/10.1504/IJMED.2010.036122.]

-

Kodagoda, T. (2019). Gendered norms and HRM practices at workplace: Evidence from public banking sector in Sri Lanka. Indian Journal of Human Development, 13(2), 211–220.

[https://doi.org/10.1177/0973703019870882.]

-

McLaughlin, J. (2003). Standpoint theories. In: Feminist Social and Political Theory (pp, 47–69). Palgrave, London.

[https://doi.org/10.1007/978-0-230-62956-1_3]

- Ministry of Law. (2003). The Bangladesh Bank Order, 1972 (President’s Order). Dhaka.

- Mirza, A. M. B., & Jabeen, N. (2011). Gender stereotypes and women in management the case of banking sector of Pakistan. South Asian Studies, 26(2), 259–284.

- Motowidlo, S. J. (2003). Job performance. In W. C. Borman, D. R. Ilgen, & R. J. Klimoski (Eds.), Handbook of psychology: Industrial and organizational psychology, Vol. 12, pp. 39–53). John Wiley & Sons, Inc.

-

Orbih, M. U., & Imhonopi, D. (2019). Women in banking: Career choice and advancement. IOP Conference Series Materials Science and Engineering, 640(1), 012127.

[https://doi.org/10.1088/1757-899x/640/1/012127]

-

Pia, M. B., Chowdhury, M., Kundu, I., Deb, E., & Akter, K. (2019). Exploring gender issues and challenges faced by women bank employees in work and family of Sylhet city, Bangladesh. Asian Journal of Agricultural Extension, Economics & Sociology, 35(3), 1–12.

[https://doi.org/10.9734/ajaees/2019/v35i330225.]

-

Qamruzzaman, M., and Jianguo, W. (2017). Financial innovation and economic growth in Bangladesh. Financial Innovation, 3(1), 1–24.

[https://doi.org/10.1186/s40854-017-0070-0.]

-

Rahman, M. F. (2019). Work–life balance as an indicator of job satisfaction among the female bankers in Bangladesh. European Journal of Business and Management, 11(6), 15–25.

[https://doi.org/10.7176/ejbm/11-6-03.]

-

Rahman, M. A., & Khan, M. R. A. (2020). Investigating the effect of women’s position on advancement in the banking sector of Bangladesh. International Journal of Social Sciences and Management, 7(4), 191–197.

[https://doi.org/10.3126/ijssm.v7i4.32483.]

- Rahman, M. M., Gupta, A. D., & Moudud-Ul-Huq, S. (2012). Job satisfaction of female employees in financial institutions of Bangaldesh: A study on selected private commercial banks. Global Journal of Management and Business Research, 12(14), 49-55.

- Rashid, A. (2018). IDLC monthly business review. IDLC Finance Limited, 14(12), 1–44.

-

Ruck, N., Rutherford, A., Brunner, M., & Hametner, K. (2019). Scientists as (not) knowing subjects: Unpacking standpoint theory and epistemological ignorance from a psychological perspective. In Psychological Studies of Science and Technology (pp. 127–48). Cham: Palgrave Macmillan.

[https://doi.org/10.1007/978-3-030-25308-0_6]

-

Saif, A. N. M., Uddin, M. D., Haque, A. K. M. A., Rahman, M. M., & Al Mamun, M. A. (2016). Factors affecting job satisfaction of female employees of private commercial banks in Bangladesh: An empirical investigation. Human Resource Management Research, 6(3), 65–72.

[https://doi.org/10.5923/j.hrmr.20160603.02]

- Sands, L. (2022). What is flexible working? Breathehr. Retrieved June 12, 2024, from https://www.ciphr.com/blog/what-is-flexible-working

-

Sarker, S., Ghosh, S. K., & Palit, M. (2015). Role of banking-sector to inclusive growth through inclusive finance in Bangladesh. Studies in Business and Economics, 10(2), 145–159.

[https://doi.org/10.1515/sbe-2015-0026.]

- Siddikee, M. J. A., Parvin, S., & Hossain, M. S. (2013). Banking scenarios in Bangladesh. Bangladesh Research Publication Journal, 8(1), 89–95.

- Staff Correspondent. (2024). Women’s representation in banking sector stuck at 16pc for 3 yrs. Prothom Alo. Retrieved March 6, 2024, from https://en.prothomalo.com/business/local/idgcrupauf

-

Tabassum, N., and Nayak, B. S. (2021). Gender stereotypes and their impact on women’s career progressions from a managerial perspective. IIM Kozhikode Society and Management Review, 10(2), 192–208.

[https://doi.org/10.1177/2277975220975513.]

- Thomas, M. (2022). What does work–life balance even mean? Forbes, July 26, 1–9. Retrieved July 26, 2022, from https://www.forbes.com/sites/maurathomas/2022/07/26/what-does-work-life-balance-even-mean, /

- Uddin, A. K. M. Z. (2022). Women’s employment in banks rises slightly. The Daily Star, October 11, 7. Retrieved from https://www.thedailystar.net/business/economy/news/womens-employment-banks-rises-slightly-3139621

- Uddin, M., Ali, K., & Khan, M. A. (2020). Impact of perceived family support, workplace support, and work–life balance policies on work–life balance among female bankers in Bangladesh. Purchase intention towards halal products in Bangladesh: A moderate muslim country perspective view project IMPAC. International Journal of Economics, 28(1), 97–122. doi.org/10.31436/ijema.v28i1.769

-

Uddin, M. K., & Kabir, M. J. (2016). Satisfaction towards banking profession: A comparative study on male and female executives. IIUC Studies, 12 (1), 127–138.

[https://doi.org/10.3329/iiucs.v12i0.30586.]

- Udu, G. O. C., & Eke, G. J. (2018). Occupational stress and job performance of female bankers in bank branches in Abakaliki, Nigeria. International Journal of Development and Management Review (INJODEMAR), 13(1), 59-72. Retrieved from https://www.ajol.info/index.php/ijdmr/article/download/172259/161658

- WFID. (2022). Towards women’s financial inclusion: A gender data diagnostic of Bangladesh. Dhaka, Bangladesh

Biographical Note: Tanjil Ahmed serves as an Assistant Professor in the Department of Public Administration and Governance Studies at Jatiya Kabi Kazi Nazrul Islam University, Bangladesh. His research interests encompass gender studies, local government, public policy, and education. He has contributed several research articles to reputable national and international journals, demonstrating his commitment to advancing knowledge in his areas of expertise. Email: tanjilahmedtaj@gmail.com

Biographical Note: Tamanna Akter is a postgraduate student. She completed her graduation and post-graduation at the Department of Public Administration and Governance Studies at Jatiya Kabi Kazi Nazrul Islam University, Bangladesh. Her research focuses on gender studies, governance issue, and public administration, and she has authored several publications in these areas, contributing to the academic discourse on these critical issues. Email: tamannakadir2019@gmail.com